- Autonomous Vehicles and Their Impact on Trucking Insurance

- Telematics and Usage-Based Insurance Solutions

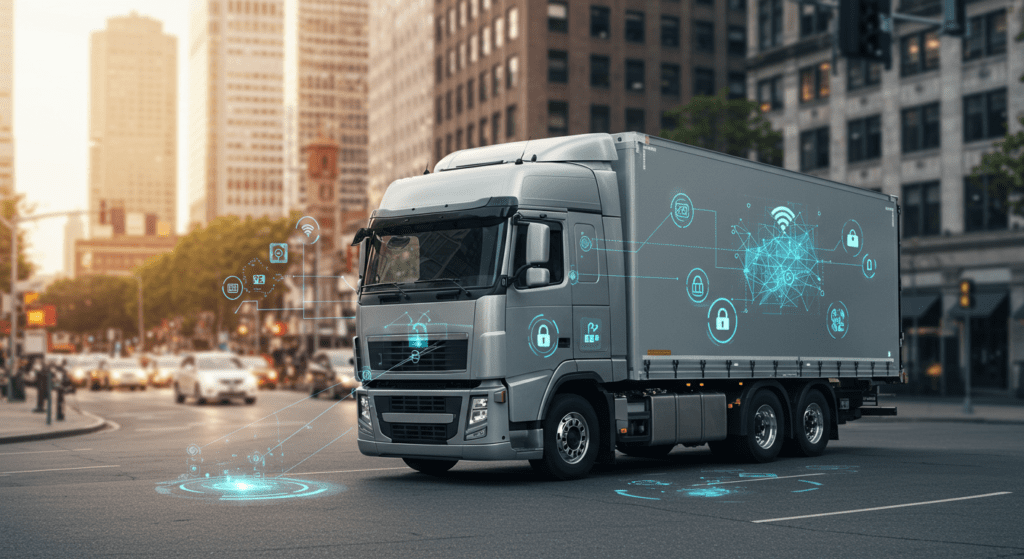

- Cybersecurity Risks and Coverage for Connected Trucks

- Environmental Regulations and Sustainable Insurance Options

- Predictive Analytics Enhancing Risk Assessment

- Customized Insurance Products for Niche Trucking Markets

- Changes in Regulatory Framework Affecting Trucking Insurance

- The Role of Artificial Intelligence in Claims Processing

- Driver Safety Programs and Their Influence on Insurance Premiums

- Market Consolidation and Its Effect on Insurance Availability and Pricing

1. Autonomous Vehicles and Their Impact on Trucking Insurance

The advent of autonomous vehicles is revolutionizing the trucking industry, significantly influencing insurance dynamics. With reduced human error, the frequency of accidents is expected to decline, potentially lowering insurance premiums. Insurance companies are adapting by developing new policies that account for the technology’s reliability and the shifting liability from drivers to manufacturers or software providers.

Additionally, the integration of autonomous systems requires insurers to consider the cost of repairs for advanced technologies and the implications of software malfunctions. As autonomous trucks become more prevalent, the insurance landscape will continue to evolve, offering tailored solutions that reflect the changing risk profiles.

2. Telematics and Usage-Based Insurance Solutions

Telematics technology is transforming trucking insurance by enabling usage-based insurance (UBI) models. By collecting real-time data on driving behaviors, such as speed, braking patterns, and route efficiency, insurers can assess risk more accurately.

This data-driven approach allows for personalized premiums based on actual usage and driving performance, encouraging safer driving habits and reducing the likelihood of accidents. Telematics also facilitates proactive maintenance and fleet management, further mitigating risks. As UBI gains traction, trucking companies can benefit from lower insurance costs and enhanced operational efficiency through tailored insurance solutions.

3. Cybersecurity Risks and Coverage for Connected Trucks

As trucks become increasingly connected through IoT devices and advanced communication systems, cybersecurity emerges as a critical concern. Connected trucks are vulnerable to cyberattacks that can disrupt operations, compromise sensitive data, and even manipulate vehicle controls.

Insurance policies must evolve to address these cybersecurity risks, offering coverage for data breaches, ransomware attacks, and system failures. Insurers are collaborating with cybersecurity experts to develop comprehensive coverage options that protect trucking companies from financial losses and reputational damage. Ensuring robust cybersecurity measures and appropriate insurance coverage is essential for maintaining the integrity and reliability of connected trucking operations.

4. Environmental Regulations and Sustainable Insurance Options

Environmental regulations are shaping the trucking insurance landscape by promoting sustainability and reducing the carbon footprint of fleets. Insurers are offering sustainable insurance options that incentivize eco-friendly practices, such as the adoption of electric or hybrid vehicles, fuel-efficient driving techniques, and the implementation of emission reduction technologies.

Compliance with environmental standards is becoming a key factor in risk assessment and premium calculations. Additionally, sustainable insurance products may include coverage for green technologies and support initiatives that contribute to environmental conservation. By aligning insurance offerings with environmental regulations, the industry fosters a more sustainable and responsible trucking sector.

5. Predictive Analytics Enhancing Risk Assessment

Predictive analytics is enhancing risk assessment in trucking insurance by leveraging big data and machine learning algorithms. Insurers analyze vast amounts of data, including historical claims, driving behaviors, weather patterns, and market trends, to predict potential risks and calculate accurate premiums.

This proactive approach enables insurers to identify high-risk factors, prevent losses, and optimize underwriting processes. Predictive analytics also facilitates the development of personalized insurance products that cater to the specific needs of trucking companies. By harnessing the power of data, predictive analytics empowers insurers to make informed decisions, improve risk management, and offer competitive insurance solutions.

6. Customized Insurance Products for Niche Trucking Markets

The diverse nature of the trucking industry necessitates customized insurance products tailored to niche markets. Specialized segments, such as refrigerated transport, hazardous materials hauling, and long-haul operations, face unique risks that require targeted coverage. Insurers are developing bespoke policies that address the specific challenges and regulatory requirements of these niche markets.

Customized insurance products offer comprehensive protection, including liability coverage, cargo insurance, and equipment protection, ensuring that trucking companies are adequately safeguarded against industry-specific risks. By catering to the distinct needs of various trucking niches, insurers can provide more relevant and effective insurance solutions.

7. Changes in Regulatory Framework Affecting Trucking Insurance

Evolving regulatory frameworks significantly impact trucking insurance by introducing new compliance requirements and altering risk landscapes. Government regulations related to safety standards, emissions, and driver qualifications necessitate adjustments in insurance policies and premium structures. Insurers must stay abreast of regulatory changes to ensure compliance and accurately assess risks.

Additionally, regulatory shifts can influence liability assignments and coverage obligations, affecting how insurers structure their products. Proactive adaptation to regulatory developments enables insurers to maintain relevance and provide trucking companies with policies that meet current legal standards and industry expectations.

8. The Role of Artificial Intelligence in Claims Processing

Artificial intelligence (AI) is revolutionizing claims processing in trucking insurance by enhancing efficiency and accuracy. AI-powered systems streamline the claims workflow by automating data collection, verification, and analysis. These technologies can quickly assess damage, determine liability, and calculate settlements, significantly reducing processing times and minimizing human error.

Additionally, AI algorithms can detect fraudulent claims by identifying inconsistencies and suspicious patterns, thereby protecting insurers from financial losses. The integration of AI in claims processing not only improves operational efficiency but also enhances customer satisfaction by providing faster and more reliable service.

9. Driver Safety Programs and Their Influence on Insurance Premiums

Driver safety programs play a crucial role in shaping insurance premiums for trucking companies. Insurers recognize that well-trained and safety-conscious drivers are less likely to be involved in accidents, resulting in lower claims and reduced risk.

As a result, companies that implement comprehensive driver safety programs, including regular training, performance monitoring, and incentives for safe driving, often benefit from lower insurance premiums. These programs demonstrate a commitment to risk management and proactive safety measures, which insurers consider favorably during underwriting.

By investing in driver safety initiatives, trucking companies can achieve significant cost savings on insurance while promoting a culture of safety.

10. Market Consolidation and Its Effect on Insurance Availability and Pricing

Market consolidation in the trucking industry has notable implications for insurance availability and pricing. As larger trucking firms dominate the market, they often have greater negotiating power to secure favorable insurance terms and lower premiums due to economies of scale and reduced risk profiles.

However, smaller trucking companies may face challenges in accessing competitive insurance options, potentially leading to higher premiums or limited coverage availability. Additionally, consolidation can influence the overall insurance market by shifting demand dynamics and affecting the distribution of risk among insurers.

Understanding the impact of market consolidation helps trucking companies navigate insurance options and make informed decisions to optimize their insurance coverage and costs.