- Overview of Natural Disasters and Their Increasing Frequency

- How Disasters Affect Insurance Risk Assessments

- Changes in Policy Terms and Premium Adjustments

- Understanding Coverage Limitations and Exclusions

- The Claims Process in the Aftermath of a Disaster

- Mitigation and Preparedness Strategies for Homeowners

- Federal and Local Assistance Programs for Disaster Relief

- The Role of Reinsurance in Managing Disaster Losses

- Future Trends in Homeowners Insurance and Climate Change

- Practical Tips for Protecting Your Home and Financial Wellbeing

1. Overview of Natural Disasters and Their Increasing Frequency

Natural disasters have become more common and severe in recent years. Earthquakes, hurricanes, wildfires, floods, and other extreme weather events have dramatically increased in frequency and intensity. Homeowners are facing heightened risks as these events not only threaten physical safety but also place a heavy burden on personal finances. The combination of climate change and urban expansion into vulnerable areas means that insurance companies must reassess risk models. This review is essential because insurance policies are built on statistical predictions of potential losses, and natural disasters are proving to be less predictable than ever before.

2. How Disasters Affect Insurance Risk Assessments

Insurance companies rely on past data to forecast future risks. When natural disasters occur more frequently, the statistical models used for risk assessments require frequent updates. Insurers now incorporate detailed geographic information, historical disaster trends, and predictions about future climate events. This shift means that areas once considered low risk may now be categorized as high risk. As risk increases, insurers adjust their underwriting practices and pricing strategies to ensure that their policies remain sustainable. This proactive approach is designed not only to protect the financial health of insurance companies but also to maintain a degree of security for policyholders.

3. Changes in Policy Terms and Premium Adjustments

When the frequency and intensity of natural disasters increase, policy terms and premiums are also subject to change. Insurers may add specific endorsements or exclusions related to natural disasters. For example, some policies may exclude certain types of flood damage or require additional premiums for high-risk areas. Homeowners might notice that premium adjustments occur more frequently following a major disaster event. These adjustments reflect the updated risk assessments performed by insurance companies, ensuring that premiums align with the true probability of catastrophic loss. In many cases, policyholders may need to enhance their coverage by adding separate endorsements or purchasing supplemental policies to protect against specific risks.

4. Understanding Coverage Limitations and Exclusions

Homeowners should be aware that most insurance policies have limitations and exclusions that can affect their coverage in times of natural disaster. A common example is flood insurance, which is often not included in a standard homeowners policy and must be purchased separately. Additionally, certain types of damage from earthquakes, hurricanes, or wildfires may have sublimits or exclusions under existing policies. It is crucial for homeowners to carefully review their terms so they can fully understand what is and isn’t covered. This clarity enables homeowners to make informed decisions about additional insurance products or changes that might be necessary to fully protect their assets.

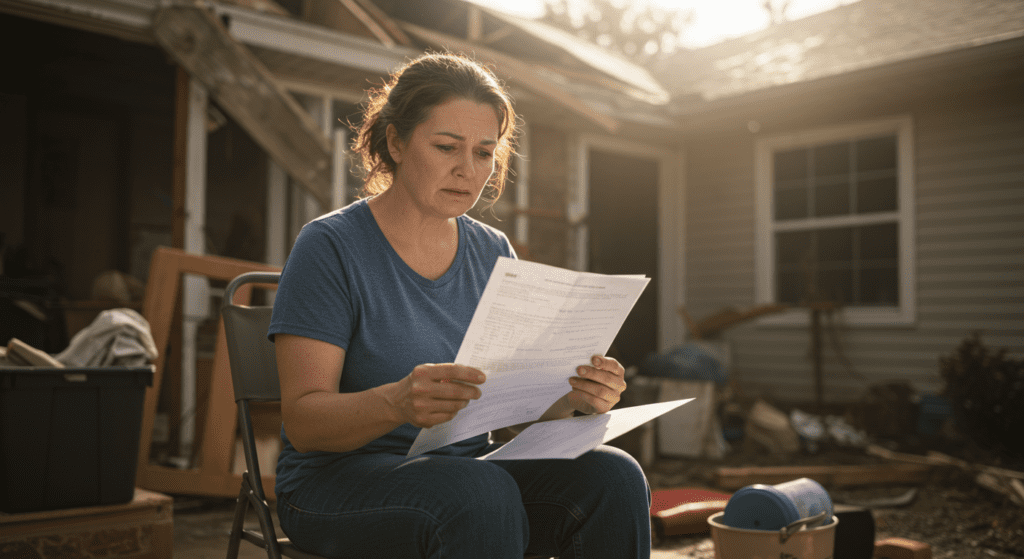

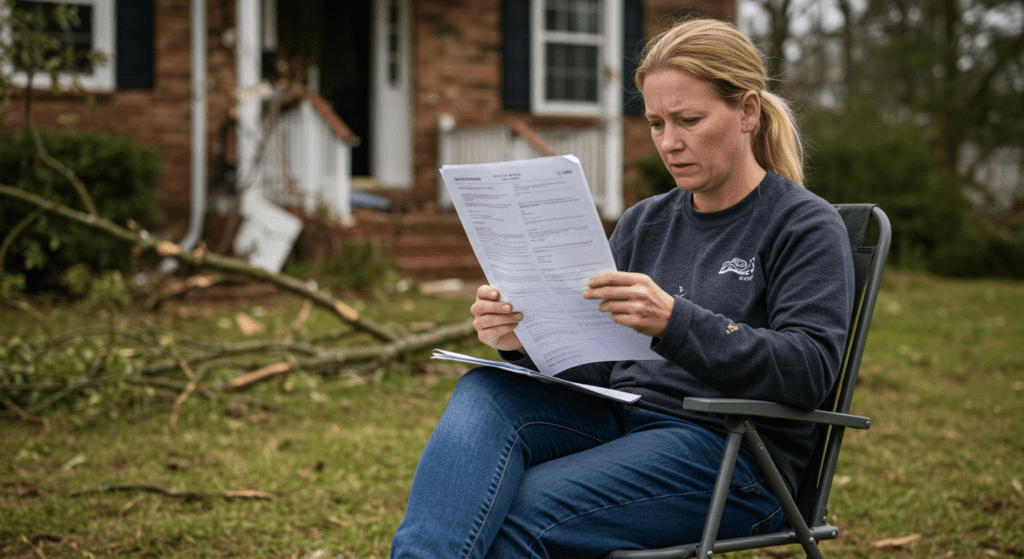

5. The Claims Process in the Aftermath of a Disaster

When a disaster strikes, the claims process becomes a critical component of recovery. After securing safety, homeowners must document damages accurately by taking photos, gathering receipts, and compiling relevant records. Contacting your insurance company promptly is essential. Claims adjusters are then assigned to evaluate the damage and confirm the extent of losses. This process can sometimes be challenging due to the overwhelming volume of claims in the immediate aftermath of a large-scale disaster. Homeowners should maintain patience and persistence while keeping detailed records of all conversations and transactions with their insurer. Understanding the claims process can help reduce stress and ensure timely settlements to help restore normalcy.

6. Mitigation and Preparedness Strategies for Homeowners

Prevention is always better than cure, especially when facing the possibility of a natural disaster. Homeowners can adopt several mitigation strategies to reduce potential damage. Installing storm shutters, reinforcing roofs, and securing landscaping are practical measures that can help protect your home. Additionally, investing in modern monitoring systems, such as smart smoke detectors or flood sensors, can alert residents before conditions worsen. Routine maintenance and periodic inspections of the property are essential to identify vulnerabilities. By proactively making improvements and adopting safety measures, homeowners can not only reduce the severity of damage but also secure more favorable terms when renewing their insurance policies.

7. Federal and Local Assistance Programs for Disaster Relief

In the wake of natural disasters, federal and local governments often step in with assistance programs. These programs are designed to offer financial relief, support rebuilding efforts, and help cover expenses that exceed insurance limits. FEMA and the Small Business Administration are examples of federal agencies that provide emergency loans and grants to individuals and communities affected by disasters. Local governments also offer additional support through community-based programs. Homeowners are encouraged to familiarize themselves with the resources available in their area. Applying for assistance promptly following a disaster can be crucial in covering unexpected costs and expediting the recovery process.

8. The Role of Reinsurance in Managing Disaster Losses

Reinsurance plays a vital role in the insurance industry by allowing primary insurers to share the risk of significant losses. Through reinsurance, insurance companies can manage and distribute the risks associated with catastrophic events. This financial tool ensures that insurers remain solvent even when faced with simultaneous large-scale claims after a natural disaster. Reinsurance arrangements provide a safety buffer that helps maintain the stability of the overall insurance system. While most homeowners may not directly notice the effects of reinsurance, its presence is critical in guaranteeing that claims can be paid out, even in the worst-case scenarios.

9. Future Trends in Homeowners Insurance and Climate Change

Climate change continues to reshape the landscape of natural disasters, pushing insurance companies to adopt innovative practices. Future trends in homeowners insurance are likely to include greater use of technology and predictive analytics. Advanced forecasting models and real-time monitoring systems may soon allow for dynamic policy adjustments and risk-based pricing. As insurers continue to adapt, policy terms might evolve to include more flexible coverage options that can respond rapidly to emerging risks. Emerging trends also suggest that insurance companies will collaborate more closely with governments and environmental agencies to create comprehensive strategies for disaster management and climate change mitigation. Homeowners who keep abreast of these changes will be better positioned to negotiate favorable terms and make informed insurance decisions.

10. Practical Tips for Protecting Your Home and Financial Wellbeing

Protecting your home from natural disasters requires proactive planning and regular reviews of your insurance policy. First, regularly evaluate your property and its location for potential risks. Make necessary modifications to reduce vulnerability, such as installing hurricane-proof windows or improving drainage systems. Second, maintain an up-to-date inventory of your belongings. This detailed record becomes invaluable when filing a claim. Third, ensure your policy limits and coverage reflect the current value of your home and possessions. It is wise to review policy terms annually and consider additional coverages for high-risk events such as floods or earthquakes. Lastly, establishing an emergency fund can provide extra security during the immediate aftermath of a disaster, helping cover temporary expenses while your claim is processed.

Natural disasters are a growing challenge for homeowners and insurers alike. With risks increasing due to climate change and evolving environmental patterns, it is more important than ever to understand how your homeowners insurance works in the context of these events. From comprehending risk assessments and policy changes to navigating the claims process after a disaster, homeowners must remain proactive in managing their coverage.

Staying informed and prepared can make a significant difference. Whether you choose to enhance your property with mitigation measures or keep a close eye on legislative changes in disaster relief programs, every step contributes to a more resilient financial future. Understanding the role of reinsurance and emerging trends not only demystifies some of the complexities behind insurance policy adjustments but also underscores the importance of continual learning in a rapidly changing risk environment.

Remember, the journey to secure your home against natural disasters goes beyond simply purchasing an insurance policy. It involves a commitment to preparedness, an understanding of policy changes, and active participation in mitigating risks. As natural disasters continue to evolve, keeping pace with these changes is essential to protect your home and the financial well-being of your family.