- Renovations That Matter: An Overview

- Structural Upgrades and Their Insurance Impact

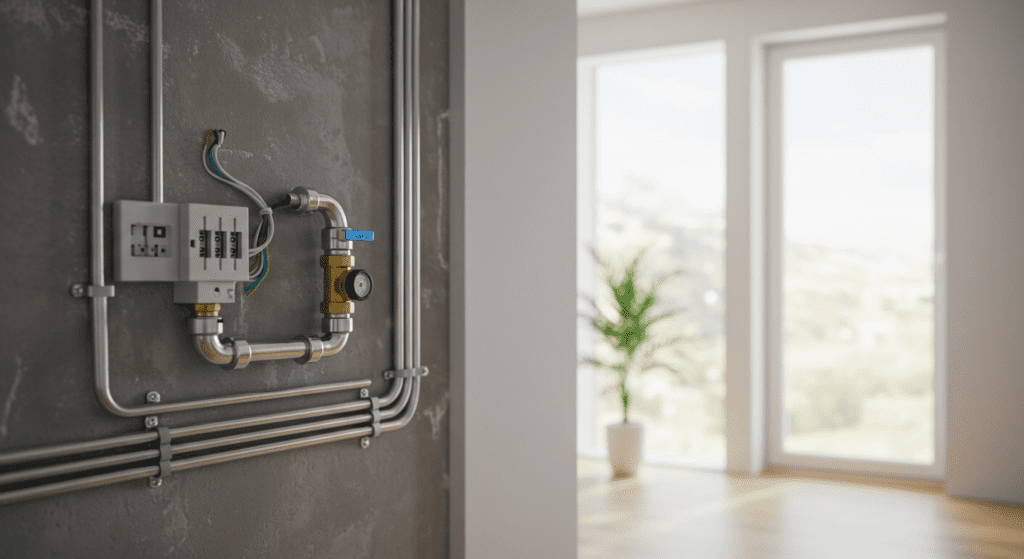

- Electrical and Plumbing Upgrades: Risk or Reward?

- Enhancing Kitchens and Bathrooms: What Insurers Consider

- Home Additions: Expanding Space and Insurance Liability

- Energy-Efficient Renovations and Premium Savings

- Cosmetic Changes vs. Substantial Remodels: Insurance Perspectives

- Assessing Renovation ROI with Insurance Implications

- Adjusting Your Insurance Policy Post-Renovation

- Practical Tips for Balancing Renovation Needs and Insurance Coverage

1. Renovations That Matter: An Overview

Home renovations not only improve your living space but also have far-reaching effects on your insurance rates. Many homeowners assume that any upgrade will increase property value and risk, leading to higher premiums. However, the relationship between renovations and insurance is complex. Certain changes can lower risks by modernizing key structural elements, while others might require increased coverage due to added value or liability. Knowing which projects impact insurance rates can help you make informed decisions that balance aesthetics, functionality, and protection.

2. Structural Upgrades and Their Insurance Impact

Structural renovations are the foundation of a home’s safety and resilience. When you update roofing, foundations, or add reinforced windows and doors, insurers often view these changes favorably. Improved building materials and modern building codes reduce the risk of damage from severe weather or fire. However, extensive remodeling that significantly increases the overall square footage or adds new levels may signal a higher replacement cost. In such cases, your insurer might adjust premiums to reflect the increased value and potential liabilities. Always consult with your insurance provider before starting major structural projects to understand the implications for coverage and future claims.

3. Electrical and Plumbing Upgrades: Risk or Reward?

Upgrading electrical systems and plumbing has become a staple in modern renovations. New wiring, circuit breakers, and advanced safety measures in electrical installations help prevent fires and electrocution risks. Similarly, updated plumbing reduces the chance of leaks that can lead to water damage, mold, or structural issues. Insurers typically commend these updates, considering them risk-reducing measures. However, improper installations or unapproved modifications may lead to claims being denied. Ensure that any renovation work complies with local building codes and is performed by licensed professionals. This due diligence not only keeps your home safe but also helps ensure your insurance remains valid and favorable.

4. Enhancing Kitchens and Bathrooms: What Insurers Consider

Kitchens and bathrooms are focal points in home renovations because of their functional significance and high usage. Upgrading these areas can involve installing modern appliances, water-efficient fixtures, or even high-end finishes. Insurers look at these renovations through the lens of both safety and risk. For example, state-of-the-art appliances with built-in safety features can reduce the risk of fire. Bathrooms with updated fixtures and slip-resistant flooring help prevent injuries. However, luxury upgrades that significantly boost property value may require you to notify your insurer. This can lead to adjustments in the policy, ensuring that any high-cost repairs or losses are properly covered.

5. Home Additions: Expanding Space and Insurance Liability

Adding extra rooms, a sunroom, or even a secondary structure on your property is an exciting way to expand your living space. Home additions increase the overall value and functionality of your property, but they also introduce new risks and potential liabilities. Insurers assess these changes by considering the total replacement cost and the potential for additional perils. For instance, adding a pool or outdoor entertainment area might require extra coverage since these features often come with increased liability risks. Keeping detailed plans and obtaining the necessary permits can help smooth the process when informing your insurance company about these modifications.

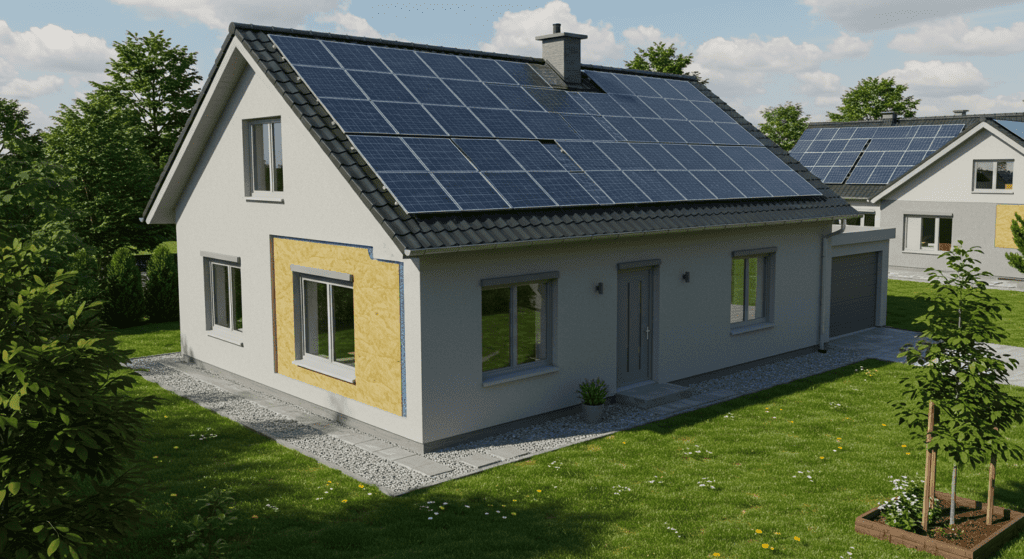

6. Energy-Efficient Renovations and Premium Savings

Energy-efficient upgrades are among the most beneficial renovations when it comes to long-term savings and maintenance costs. Installing solar panels, energy-efficient windows, and modern insulation does more than just lower your monthly utility bills; it can also reduce your insurance premiums. Many insurers appreciate these upgrades due to the overall decreased risk of catastrophic events. For example, solar panels that include integrated surveillance systems may deter potential intruders, reducing the likelihood of break-ins. In addition, homes with better insulation and energy management systems tend to have lower rates of accidental damage. Homeowners should discuss these improvements with their insurer to potentially discover premium discounts or incentive programs specifically designed for energy-efficient properties.

7. Cosmetic Changes vs. Substantial Remodels: Insurance Perspectives

Not all renovations are created equal when it comes to insurance implications. Cosmetic changes like painting, updating fixtures, or installing new flooring generally do not affect your insurance policy because they neither alter the structure nor the risk profile of your home. On the other hand, substantial remodels such as altering room layouts or changing the structural integrity of your home can have a notable impact on your insurance rate. Major alterations might increase your home’s market value and change the scope of replacement costs in the event of a disaster. While aesthetic improvements are enjoyable and relatively straightforward in terms of insurance, significant remodels require a detailed review with your provider to ensure that nothing is overlooked.

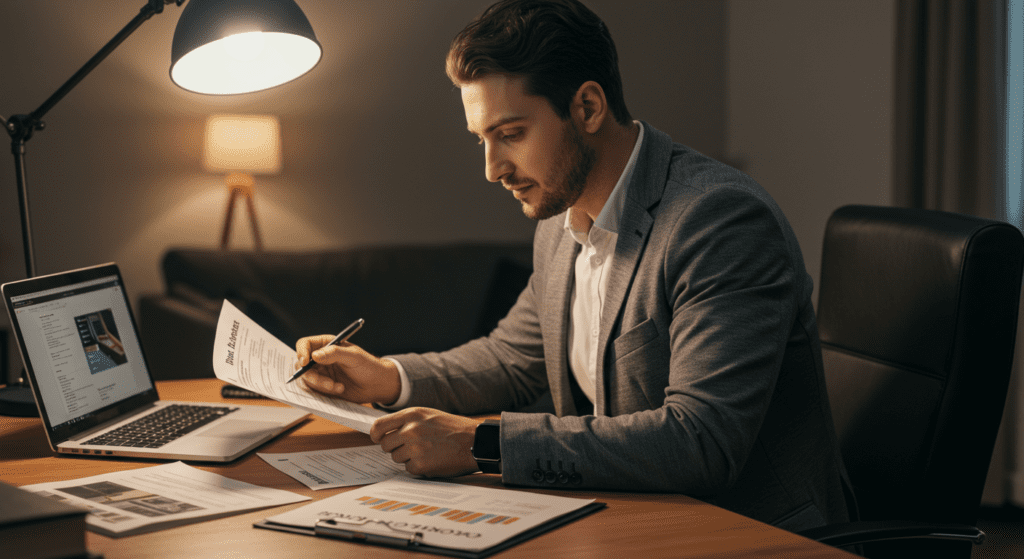

8. Assessing Renovation ROI with Insurance Implications

When planning any renovation, homeowners often consider the return on investment (ROI)—not just in terms of property value, but also in insurance benefits. Proper renovations can lead to lower insurance costs by mitigating risks and modernizing outdated systems. On the flip side, extensive upgrades that significantly increase the property value might also translate into higher premiums. The key is to balance aesthetic desires and functional improvements with the financial realities of increased coverage needs. Speaking with an insurance agent before embarking on expensive projects can reveal opportunities to negotiate lower premiums or identify features that might qualify for discounts, ultimately impacting the overall ROI of your renovation.

9. Adjusting Your Insurance Policy Post-Renovation

Once your home improvements are complete, it is essential to update your insurance policy to accurately reflect the new property value and risk factors. Failure to notify your insurer about significant modifications can lead to coverage gaps. Start by compiling detailed documentation of the renovations, including photographs, permits, and contractor invoices. This information will help your provider reassess the replacement cost and ensure that you have adequate coverage without overpaying. Many insurance companies offer policy reviews after major renovations; taking advantage of these evaluations can provide peace of mind and potentially uncover savings when adjustments are made appropriately.

10. Practical Tips for Balancing Renovation Needs and Insurance Coverage

To safeguard your investment and maintain reasonable insurance premiums, consider these practical tips:

Consult with insurance professionals before starting any major renovation project. This dialogue will help you understand how each upgrade might impact your policy.

Always hire reputable, licensed contractors who follow local building codes. Not only does this ensure the quality of your work, but it also gives your insurance provider confidence in the renovations.

Keep meticulous records of all renovations, permits, and receipts. These documents are vital if you ever need to file a claim or adjust your coverage.

Consider bundling energy-efficient and safety improvements with necessary structural changes. This approach can maximize the safety benefits while mitigating increased insurance costs.

Regularly schedule reviews with your insurance provider. A yearly policy review ensures that your coverage remains up to date with any home improvements or market changes.

Understand that not all improvements lead to higher premiums. In many cases, investing in modern safety features and efficient systems can actually lead to discounts or lower claims in the long term.

Home renovations offer a unique opportunity to improve your quality of life, increase property value, and reduce risks. However, the impact on insurance rates can vary considerably depending on the nature and scope of the project. Structural upgrades and energy-efficient improvements often result in lower risk, and, in turn, more favorable premiums. Meanwhile, extensive remodels or additions might result in higher expenditure in insurance coverage due to increased liabilities.

By understanding the insurance implications of different renovation projects, homeowners can approach upgrades strategically. Rather than seeing insurance as a deterrent, think of it as an important factor in shaping your renovation plans. With careful assessment and clear communication with your provider, you can create a safe, modern, and beautiful home that is both well-protected and financially sound.

In summary, each change you make to your home reflects not only your personal style but also plays a key role in your overall risk profile. A practical strategy that includes consulting the experts, thorough documentation, and regular review of your policies will ensure your home stays covered, no matter how much you improve it. Whether you are planning a quick cosmetic upgrade or a complete structural overhaul, aligning your renovation projects with smart insurance practices is a valuable investment in your home’s future.