- Overview of Auto Insurance Providers

- Key Features of Top Auto Insurance Companies

- Understanding Coverage Options and Policies

- Pricing and Value: Comparing Costs Across Providers

- Customer Service and Claims Handling Excellence

- Discounts, Rewards, and Loyalty Programs

- Online Tools and Policy Management Features

- Reviews, Ratings, and Consumer Feedback

- Regional Differences and Market Variability

- Final Recommendations and Choosing the Right Provider

1. Overview of Auto Insurance Providers

Auto insurance is a crucial element for every driver. Understanding the differences between providers can save you money and offer peace of mind on the road. This article explores the top auto insurance companies, compares their key features, and helps you choose the provider that best suits your needs. In today’s competitive market, having the right provider means more than just a low premium—it means quality coverage, excellent customer service, and efficient claims handling.

2. Key Features of Top Auto Insurance Companies

The leading auto insurance companies offer a wide range of benefits that cater to the needs of drivers across various age groups and regions. Among these features, several stand out. Many providers emphasize customizable policies, offering drivers the flexibility to choose the coverage that fits their lifestyle and budget. In addition, top insurers invest in advanced safety programs and driver education initiatives, which not only promote road safety but can also lead to additional discounts. Another important feature is the integration of technology to streamline services such as mobile claims reporting, policy updates, and payment options. Innovation and consistent performance in the market are clear indicators of a company’s commitment to customer satisfaction and overall service excellence.

3. Understanding Coverage Options and Policies

Coverage options vary greatly among auto insurance providers. Your policy could include different types of coverage—from liability and collision to comprehensive protection. Liability coverage is mandatory in most states and covers damages to other drivers and property in the event of an accident. Collision coverage, on the other hand, takes care of your vehicle when accidents occur, regardless of who is at fault. Comprehensive policies offer protection against non-collision incidents like theft, vandalism, or natural disasters. Some providers also offer add-ons such as roadside assistance, rental reimbursement, and gap insurance. When comparing policies, it is essential to examine which features are included as standard and which may require additional premiums. This detail helps you create a policy that not only protects you but also fits your financial plan.

4. Pricing and Value: Comparing Costs Across Providers

While cost is a primary concern for many drivers, the lowest premium does not always mean the best choice. Pricing across various providers is influenced by multiple factors including driving history, vehicle type, location, and coverage limits. Many auto insurance providers offer competitive pricing structures with incentives for safe driving and maintaining a good credit score. When comparing costs, it is important to note that value is measured not just by price but by what the premium covers. Some companies may provide extensive coverage options for a slightly higher rate, while others focus on budget-friendly policies with essential protection. Evaluating the overall value means taking into account factors such as financial stability, claims satisfaction rates, and the range of services provided.

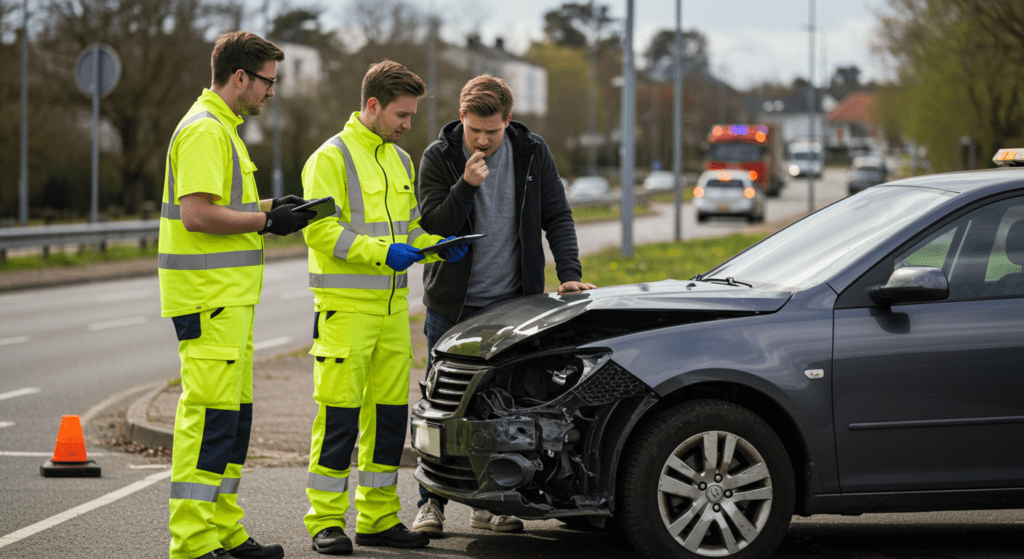

5. Customer Service and Claims Handling Excellence

Top auto insurance companies are recognized for their exceptional customer service. Efficient claims handling is at the heart of a reliable insurer, supporting customers through stressful times after an accident or damage to their vehicle. Fast response times, transparent communication, and the availability of digital claim submission tools contribute greatly to customer satisfaction. A provider’s reputation in dealing with claims can often be the deciding factor for consumers. Companies with a strong track record of prompt payments and fair settlements foster trust among policyholders. Additionally, high availability through multiple customer service channels—including 24/7 hotlines, online chat support, and mobile apps—ensures that help is always at hand when it is most needed.

6. Discounts, Rewards, and Loyalty Programs

Discounts and rewards are a major incentive for drivers when choosing an auto insurance provider. Many companies offer multi-policy discounts for those who bundle auto insurance with home or rental coverage. Safe driver programs and accident forgiveness policies can also result in lower premiums over time. Loyalty programs reward long-term customers with added benefits such as premium reductions, accident forgiveness, or enhanced coverage options. These programs indicate that the provider values customer retention and recognizes the importance of a mutually beneficial relationship. When comparing discounts, it is essential to check the conditions and determine how they apply to your personal situation. Effective use of these discounts can lead to substantial savings without compromising coverage quality.

7. Online Tools and Policy Management Features

The advancement of technology has revolutionized the insurance industry. Modern auto insurance providers emphasize user-friendly online platforms that simplify policy management and claims reporting. Consumers today expect to handle tasks such as obtaining quotes, updating policy details, and tracking claims through secure digital portals. These online tools not only increase the convenience factor but also enhance transparency and speed in communication. Mobile apps with features like digital ID cards, online payments, and real-time notifications about policy changes are becoming standard practice. By investing in these technologies, auto insurance providers offer a seamless experience that aligns with the digital habits of today’s consumers. Choosing a provider with robust online capabilities can save time and stress, making insurance management easier for busy drivers.

8. Reviews, Ratings, and Consumer Feedback

Consumer feedback is a valuable resource when evaluating an auto insurance provider. Numerous online review platforms and industry rating agencies offer insights into the real-world performance of insurance companies. Key indicators such as customer satisfaction scores, claim settlement efficiency, and overall service quality are often highlighted. Consumers sharing their personal experiences can provide invaluable information that is not readily available from the provider’s marketing materials. Ratings from trusted entities such as J.D. Power, Consumer Reports, and the Better Business Bureau can further validate the claims regarding service quality and reliability. Studying these reviews and ratings helps prospective customers make informed decisions and select providers that have proven their worth in customer care and reliability.

9. Regional Differences and Market Variability

Auto insurance costs and coverage options can differ significantly by region. Factors such as local regulations, road conditions, and regional crime rates play a role in shaping both pricing and policy details. Providers often adjust premiums based on the risk levels prevalent in a specific area. For example, urban areas with heavy traffic tend to have higher premiums compared to rural locations. In addition, some insurance companies tailor their policies to meet the unique needs of regional drivers. Understanding these variations is crucial when shopping for auto insurance, especially if you move between regions or reside in a high-risk area. It is wise to request quotes from providers who have a strong presence in your region, ensuring that regional factors are properly taken into account. This approach can save money and lead to more personalized service.

10. Final Recommendations and Choosing the Right Provider

When it comes to selecting the right auto insurance provider, the decision should be based on a blend of pricing, coverage, technology, and customer service. Start by evaluating your coverage needs and reviewing the benefits offered by top companies. Look for policies that provide the best balance between comprehensive coverage and cost-effectiveness. Additionally, consider the provider’s reputation for handling claims. A company that excels in customer service, offers responsive online tools, and provides generous discounts should be at the top of your list.

Before making a final decision, consult consumer reviews and ratings from trusted sources. Regional considerations should not be overlooked—ensure that the provider is well-versed in the market conditions of your area and can offer tailored solutions. Comparing several providers using online quote tools can also highlight subtle differences in coverage and price, eventually guiding you towards the most beneficial option for your driving profile.

Your final decision should ultimately be based on a provider’s overall value proposition. Investing time to research and compare different auto insurance companies keeps you well-informed and can lead to long-term savings. With the right blend of features, responsive customer service, and flexible pricing options, you will find a provider that not only protects you on the road but also supports your needs over the long haul.

Conclusion

In conclusion, understanding the competitive nature of today’s auto insurance market helps you recognize that a higher premium might bring additional value and a better safety net. Whether you are seeking comprehensive coverage, attractive discounts, or a technologically advanced platform for managing your policy, the key is finding a provider that aligns with your specific requirements. Evaluate your priorities, seek recommendations, and use the available online tools to make an informed decision. The right auto insurance provider will not only protect your vehicle but also provide you comfort and confidence every time you drive.