- Overview of Trucking Insurance Benefits

- Case Study: Collision Recovery and Coverage

- Case Study: Liability Protection in Major Accidents

- Case Study: Safeguarding Cargo Through Insurance

- Case Study: Minimizing Downtime After an Accident

- Case Study: Navigating Legal Challenges with Insurance Support

- Case Study: Financial Stability Post-Accident

- Case Study: Preserving Business Reputation After Incidents

- Case Study: Enhancing Driver Safety Programs with Insurance

- Case Study: Streamlining Claims Management Processes

1. Overview of Trucking Insurance Benefits

Trucking insurance plays a crucial role in safeguarding transportation businesses against the myriad risks inherent in the industry. From protecting financial assets to ensuring compliance with legal requirements, trucking insurance provides comprehensive coverage that shields companies from unforeseen events.

The benefits extend beyond mere financial protection; they enhance business credibility, support operational continuity, and contribute to driver safety initiatives. Understanding these benefits is essential for trucking companies aiming to navigate the complexities of the transportation sector effectively.

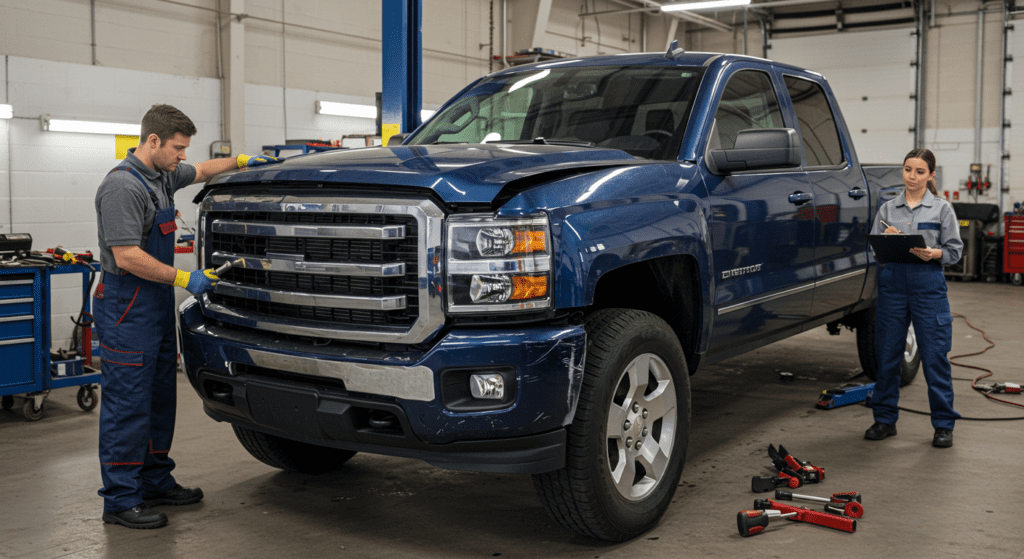

2. Case Study: Collision Recovery and Coverage

A mid-sized trucking company faced a severe collision on a major highway, resulting in significant damage to their fleet. Thanks to their comprehensive collision coverage, the insurance swiftly covered repair costs, minimizing the company’s financial burden. Additionally, the policy included rental reimbursement, ensuring that the company could continue operations with minimal disruption. This prompt support not only facilitated a speedy recovery but also upheld the company’s reputation for reliability among its clients.

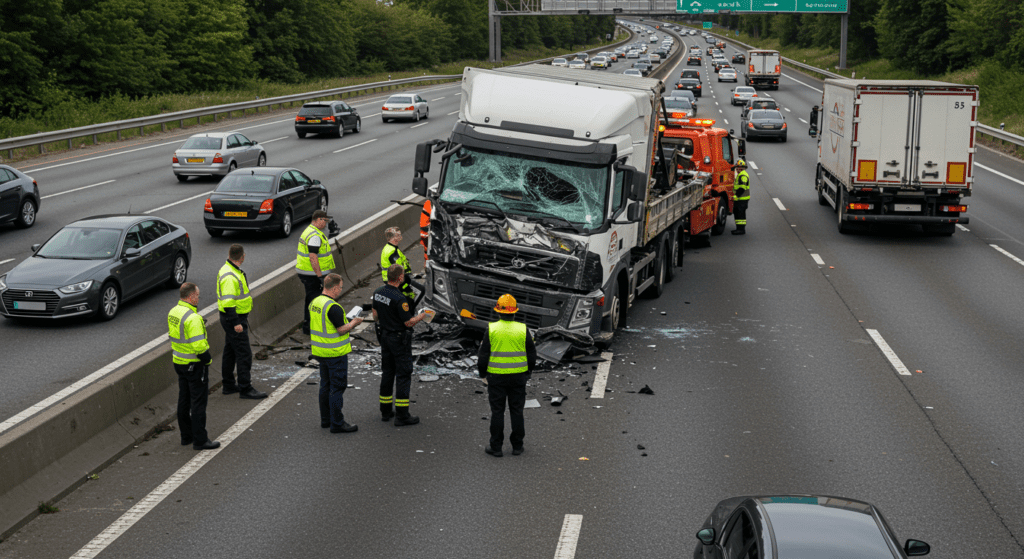

3. Case Study: Liability Protection in Major Accidents

When a trucking firm was involved in a major accident that resulted in multiple injuries, liability insurance proved indispensable. The insurance covered legal fees and settlement costs, protecting the company from potentially devastating financial liabilities. Without such protection, the business might have faced bankruptcy or severe financial strain.

This case underscores the importance of liability coverage in mitigating risks associated with large-scale accidents.

4. Case Study: Safeguarding Cargo Through Insurance

A logistics company transporting high-value electronics encountered theft during transit. Their cargo insurance policy covered the loss, allowing the company to reimburse their clients promptly and maintain trust.

This protection not only facilitated the recovery of lost goods but also preserved the company’s reputation for handling sensitive and valuable shipments securely. Insurance coverage for cargo ensures that businesses can uphold their commitments even in the face of unexpected losses.

5. Case Study: Minimizing Downtime After an Accident

Following an accident that disabled several trucks, a transportation company leveraged their business interruption insurance to cover lost income and operational costs during the downtime.

This financial support enabled the company to sustain operations, maintain payroll, and fulfill client obligations despite the unexpected halt. Minimizing downtime through insurance ensures that businesses can recover swiftly from accidents without long-term operational disruptions.

6. Case Study: Navigating Legal Challenges with Insurance Support

A trucking business confronted complex legal challenges after an accident involving multiple parties and jurisdictions. Their legal expense coverage streamlined the process by funding legal representation and related costs. This support allowed the company to focus on resolving the incident without the added stress of managing legal finances.

Effective insurance coverage can simplify the navigation of intricate legal landscapes, ensuring businesses can address incidents effectively.

7. Case Study: Financial Stability Post-Accident

After experiencing a series of minor accidents, a trucking company faced accumulating repair costs and increased premiums. Their financial protection plan, which included accident forgiveness and premium stabilization features, helped maintain financial stability.

By mitigating the impact of frequent incidents, the insurance allowed the company to invest in safety improvements and continue operations without crippling financial pressures.

8. Case Study: Preserving Business Reputation After Incidents

A transportation firm involved in a publicized accident risked damaging its reputation. Their insurance coverage included public relations support, aiding in managing communications and restoring public trust.

This proactive approach ensured that the company could address stakeholder concerns transparently and uphold its image as a responsible and dependable service provider. Preserving reputation through insurance-backed support is vital for long-term business success.

9. Case Study: Enhancing Driver Safety Programs with Insurance

A trucking company utilized their insurance data and resources to develop and enhance their driver safety programs. By analyzing incident trends covered by their policy, they identified areas for improvement and implemented targeted training initiatives.

This proactive strategy not only reduced the frequency of accidents but also lowered insurance premiums, creating a safer and more cost-effective operational environment.

10. Case Study: Streamlining Claims Management Processes

Efficient claims management is critical following an accident. A transportation company benefited from their insurer’s streamlined claims process, which included rapid assessment, documentation support, and clear communication channels.

This efficiency reduced the administrative burden on the business, allowing for faster resolution and quicker return to normal operations. A well-organized claims process is essential for minimizing the impact of accidents on business continuity.

Conclusion

These case studies highlight the pivotal role trucking insurance plays in protecting transportation businesses from a wide range of challenges post-accident. From financial recovery and liability protection to safeguarding cargo and preserving reputation, comprehensive insurance coverage ensures that trucking companies can navigate incidents with resilience and maintain operational integrity.

Investing in robust trucking insurance is not just a regulatory requirement but a strategic decision that enhances the stability and success of businesses in the competitive transportation industry.