- Overview of Apartment Building Insurance

- Understanding the Scope of Common Claims

- Water Damage and Plumbing Failures

- Fire-related Incidents and Their Impact

- Natural Disaster Claims in Multifamily Buildings

- Liability and Injury Claims in Common Areas

- Theft and Vandalism: Risk Factors and Examples

- Roof Damage and Structural Failures

- Handling Insurance Disputes and Settlements

- Best Practices for Preventing Common Claims

1. Overview of Apartment Building Insurance

Apartment building insurance plays a crucial role in protecting property owners from unexpected losses. This type of insurance covers various assets, including the physical structure, common areas, and sometimes even personal property within multifamily housing units. In a world of evolving risks—from natural disasters to increasing claims of liability—having robust insurance coverage is essential. Not only does it safeguard the investment, but it also provides peace of mind to residents and owners alike.

2. Understanding the Scope of Common Claims

Understanding the claims process is vital for anyone managing an apartment building. Common claims include structural damage, water damage, fire-related incidents, and more. These claims can be complicated, involving multiple parties and requiring extensive documentation. Property managers learn that knowing what is covered under their policy and taking precautions can help reduce claim frequency and severity over time.

3. Water Damage and Plumbing Failures

Water damage is one of the most prevalent issues in apartment buildings. Plumbing failures, burst pipes, and leaks can lead to significant repair costs. Insurance policies typically cover water damage if it results from sudden and accidental incidents. However, damage resulting from long-term issues or poor maintenance may not be covered. Regular inspections and prompt repairs can prevent minor problems from becoming catastrophic claims. Early intervention keeps the property safe and maintains tenant satisfaction.

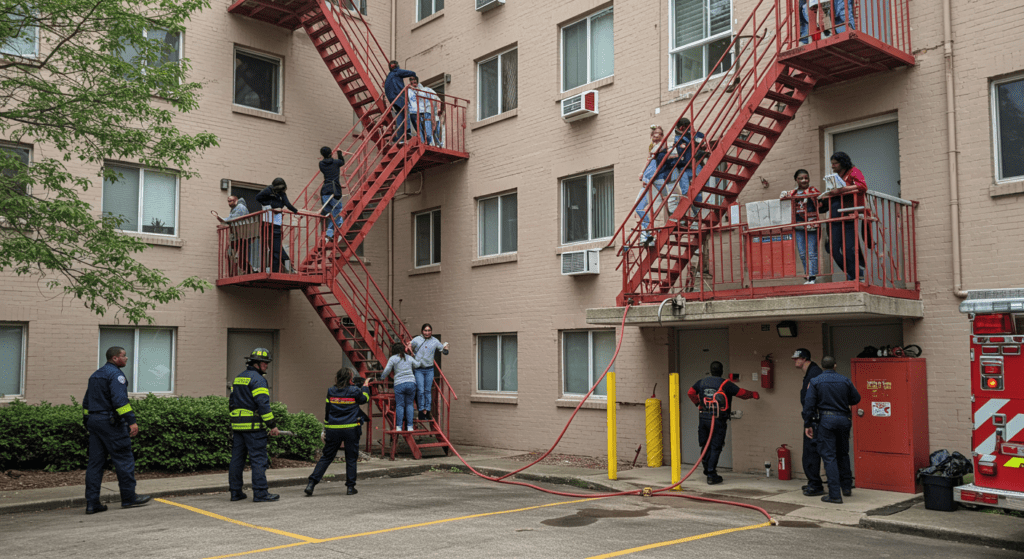

4. Fire-related Incidents and Their Impact

Fires are among the most destructive risks for apartment buildings. A small fire can quickly escalate, affecting multiple units and common areas. Insurance policies often cover fire damage under comprehensive perils, meaning that most types of fires are included. However, some policies may exclude fire-related damages caused by specific factors such as arson or negligence. Having state-of-the-art safety systems and ensuring that residents are aware of emergency exits can minimize damage. Well-placed smoke detectors and effective sprinkler systems are not just safety measures—they are also critical risk management tools.

5. Natural Disaster Claims in Multifamily Buildings

Multifamily buildings are always at risk from natural disasters. Whether it’s a hurricane, earthquake, or severe storm, these events can lead to extensive structural damage. Many insurance policies include natural disaster coverage, but it is important for property managers to know exactly what is covered. Some policies might have specific limits or require additional riders to cover events like floods or earthquakes. Preparing an emergency response plan and performing regular safety drills strengthen the building’s resilience and help minimize the number of claims when a disaster strikes.

6. Liability and Injury Claims in Common Areas

Liability claims in common areas are a major concern for apartment building owners. Areas such as hallways, stairwells, and shared facilities can be hotspots for accidents. Slips, trips, and falls are common injuries that lead to costly liability claims. Coverage for injury claims typically falls under general liability insurance. Maintaining these areas with regular cleaning, proper lighting, and timely repairs helps reduce the risk of injuries. Training staff to promptly address safety hazards is a proactive way to mitigate potential liability problems. When incidents do occur, timely reporting and clear documentation are crucial for a smooth claims process.

7. Theft and Vandalism: Risk Factors and Examples

Theft and vandalism can disrupt tenant life and cause financial losses. Common areas are vulnerable to such criminal activities, especially if management has not installed adequate security measures. Security cameras, controlled access, and well-lit corridors reduce the risk of theft and vandalism. Insurance policies will generally cover the costs of repair or replacement when a claim is filed, although deductibles might apply. In some cases, repeated incidents can lead to higher premiums or even policy cancellations. An effective strategy to prevent these crimes includes tenant education and community watch programs, which can foster a safer environment and lower insurance claims over time.

8. Roof Damage and Structural Failures

Roof damage is particularly important because it often serves as an early warning sign of broader structural issues. Over time, the roofing materials on an apartment building can deteriorate due to weather conditions, improper installation, or lack of maintenance. Insurance policies can cover repairs or full replacement in cases of sudden, accidental damage. However, issues such as long-term wear and tear might not be covered. Regular roof inspections and maintenance checks are vital preventive measures that can help property managers address potential problems before they result in insurance claims. A robust maintenance strategy plays an essential role in keeping the building structurally sound and minimizing unexpected repair costs.

9. Handling Insurance Disputes and Settlements

Insurance disputes and settlements can be challenging when disagreements on claim coverage arise. Property owners and managers should ensure they have detailed documentation of all repair and maintenance work. When disputes occur, it is important to involve professionals who understand the claims process. Hiring an experienced public adjuster or an attorney can help navigate complex disputes and reach fair settlements. Open communication with the insurance company, along with transparency in damage assessments, can pave the way for efficient conflict resolution. Having a clear dispute resolution strategy in place before incidents occur can reduce stress and time spent resolving conflicts during a claim.

10. Best Practices for Preventing Common Claims

Preventing claims before they happen is the best strategy for apartment building managers. Regular maintenance, proactive inspections, and prompt repairs are the cornerstones of risk management. Educating residents on safety practices and emergency procedures plays a significant role, too. For example, installing regular fire drills and safety workshops can greatly reduce the risk of accidents. Additionally, investing in advanced building technologies like smart leak detectors and surveillance cameras provides real-time monitoring that can prevent claims before they escalate. Property managers should also create an action plan that includes hazard mitigation, employee training, and routine policy reviews. Incorporating these best practices not only lowers insurance premiums but also fosters a safer living environment for residents.

11. Conclusion

Apartment building insurance is a critical tool in the property manager’s arsenal. Understanding the many facets of coverage—from water damage and fire incidents to theft and structural issues—helps in choosing the right policy for the building’s specific needs. Regular maintenance, proactive risk management, and an informed approach to technology and trends ensure that common claims can be minimized or managed effectively. By balancing comprehensive coverage with practical prevention practices, apartment owners can protect their investments and provide a secure living environment for tenants. The future of apartment building insurance lies in continuous education, effective planning, and the willingness to adapt in a market that is as dynamic as it is essential.