- What Is Homeowners Insurance?

- Types of Coverage: From Structural to Personal Property

- Determining Your Coverage Needs and Valuations

- Understanding Deductibles and Premiums

- How to Assess and Mitigate Risk for Your Home

- The Claims Process: Steps to Take After a Loss

- Essential Exclusions and Limitations to Be Aware Of

- Comparing Policies: Tips for Finding the Best Fit

- Discounts and Savings: Strategies to Lower Your Costs

- The Future of Homeowners Insurance: Trends and Innovations

1. What Is Homeowners Insurance?

Homeowners insurance is a contract between you and an insurance provider that protects your home and personal property from unexpected events. It typically covers damages from risks such as fires, storms, and theft. This coverage not only safeguards your investment in your home but also offers liability protection if someone is injured on your property. A standard homeowners insurance policy usually includes dwelling coverage, personal property coverage, liability coverage, and additional living expenses if your home becomes temporarily uninhabitable. Homeowners should think of this insurance as a safety net that provides financial support during challenging times. By understanding what your policy covers, you are better prepared to handle the unexpected and protect your financial future.

2. Types of Coverage: From Structural to Personal Property

Homeowners insurance is not a one-size-fits-all policy. It is divided into different types of coverage to address various aspects of home protection. Structural coverage protects the physical building, ensuring repairs or rebuilding if disaster strikes. Personal property coverage comes into play when your belongings, such as furniture, electronics, and clothing, are damaged or stolen. Liability coverage is another important aspect that protects you if someone is injured on your property or if you inadvertently cause damage to someone else’s property. Some policies include optional endorsements or additional coverage for special items like jewelry, art collections, or high-value electronics. By reviewing the types of coverage available, you can customize your policy to ensure that all areas of your home and life are adequately protected.

3. Determining Your Coverage Needs and Valuations

Evaluating your coverage needs is a crucial step in selecting the right homeowners insurance policy. Start by taking an inventory of your personal property and assessing the value of your home’s structure. Consider factors such as the cost to rebuild your home and the replacement value of your belongings. It is important to note that the market value of your home might differ from the cost to rebuild it, especially in areas with rising construction costs. Consider hiring a professional appraiser if you are unsure of your home’s rebuilt value. Moreover, factor in inflation and local market trends when estimating your coverage needs. Regular updates to your coverage amounts can prevent underinsurance, ensuring that you are fully compensated following a loss. A clear understanding of valuations also helps in making informed decisions when comparing policies and determining the best fit for your situation.

4. Understanding Deductibles and Premiums

Deductibles and premiums are key components of your homeowners insurance policy that affect your out-of-pocket costs. The deductible is the amount you must pay before your insurance policy kicks in, and it can be a flat dollar amount or a percentage of your home’s insured value. Generally, choosing a higher deductible means a lower premium, and vice versa. Your premium is the regular payment you make to maintain your coverage. Factors that influence your premium include your home’s location, age, construction materials, and the security features installed in and around your house. Insurance companies also consider your claims history and the risk associated with your neighborhood or local weather patterns. By understanding how deductibles and premiums work together, you can choose a balance that fits your budget while providing sufficient coverage in the event of a claim.

5. How to Assess and Mitigate Risk for Your Home

Assessing and mitigating risk is an ongoing process that can reduce the likelihood of damage and help lower your premiums. Start by identifying potential hazards in your area, such as flood zones, high-crime neighborhoods, or regions prone to natural disasters like earthquakes or severe storms. Many insurance companies offer discounts if you implement safety measures such as installing smoke detectors, burglar alarms, deadbolt locks, and security cameras. Routine home maintenance, including roof inspections and proper upkeep of heating and electrical systems, also reduces risk. Landscaping can play a part too; trimming trees and clearing debris can minimize damage during storms or wildfires. By proactively managing risks and discussing safety measures with your insurance provider, you can ensure that your policy reflects a realistic assessment of the dangers your home faces and possibly reduce your premiums.

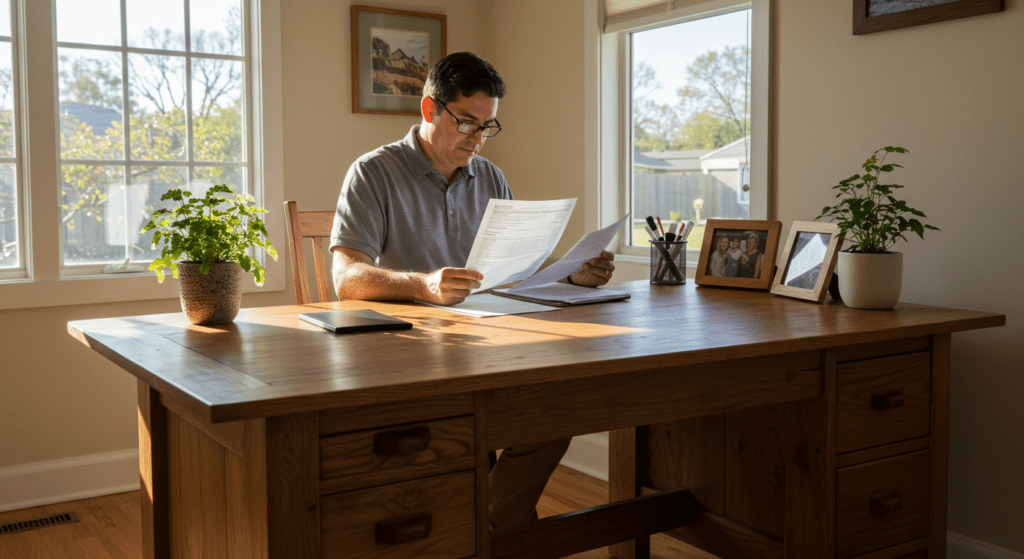

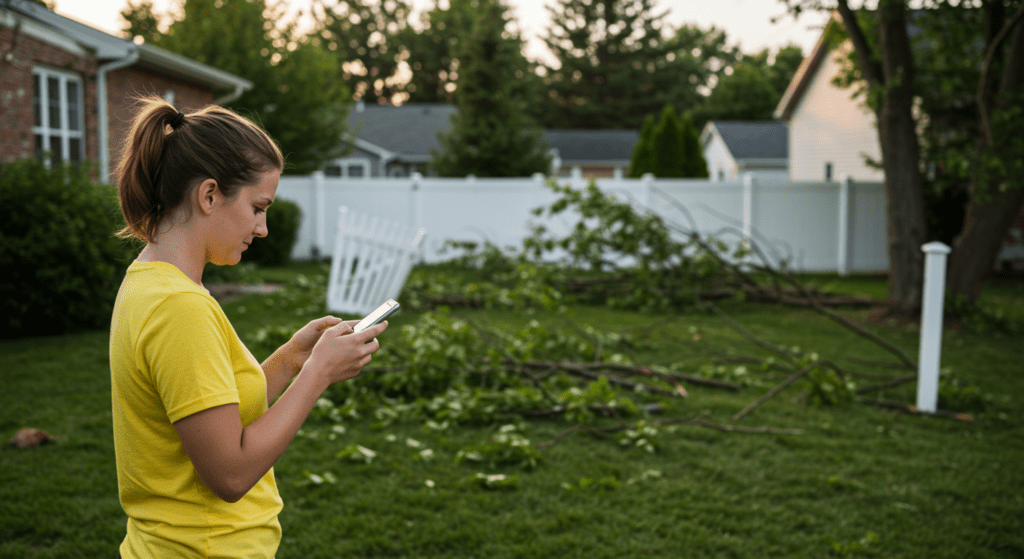

6. The Claims Process: Steps to Take After a Loss

Filing a claim can be a daunting process, but understanding the necessary steps can help ease your burden during an already stressful time. The first step is to ensure safety and, if needed, contact emergency services. Once the situation is under control, document all damages with photographs and written descriptions. Keeping detailed records of lost or damaged items will be essential during the claim process. Reach out to your insurance provider as soon as possible to report the claim. An adjuster will be assigned to assess the damage and work with you to determine the amount of compensation. Throughout this process, maintain clear communication, and ask for clarification whenever needed. Patience may be required as your claim is processed, but staying informed about each step helps ensure that you receive a fair settlement. Remember that your policy’s deductible will apply before any payouts, so having a solid understanding of your coverage details beforehand is beneficial.

7. Essential Exclusions and Limitations to Be Aware Of

While homeowners insurance covers a wide range of risks, it is important to recognize that not all perils are included. Common exclusions include flood damage, earthquakes, and wear-and-tear maintenance issues. Many policies explicitly exclude losses resulting from neglect or intentional acts. For example, damage from untreated water leaks or pest infestations might not be covered. It’s crucial for homeowners to review the list of exclusions in their policy carefully. If you live in an area prone to specific risks like flooding or seismic activity, consider purchasing additional endorsements or separate policies to bridge the gaps in coverage. Understanding these limitations helps prevent surprises in the event of a catastrophe and ensures you have the necessary safeguards in place for those high-risk scenarios.

8. Comparing Policies: Tips for Finding the Best Fit

Shopping for homeowners insurance requires a thoughtful comparison of policies. Begin by compiling a list of reputable insurers and request quotes that outline the coverage options, deductibles, premiums, and any additional endorsements. Look closely at customer service reviews and claims satisfaction ratings to gauge the insurer’s reliability and effectiveness. It’s also important to compare the fine print in each policy, focusing on limitations and exclusions. Cost is a significant factor, but the cheapest policy might not always offer the best coverage. Instead, focus on finding a plan that delivers comprehensive protection that fits your lifestyle and financial situation. Consider bundling your home insurance with other policies, such as auto insurance, to take advantage of potential discounts. A well-rounded comparison helps ensure that you choose a policy aligned with your unique needs and offers quality customer support when claims arise.

9. Discounts and Savings: Strategies to Lower Your Costs

Several strategies can help reduce the cost of homeowners insurance without compromising on coverage. One effective method is to enhance your home’s security with modern technology such as alarm systems, security cameras, and smart locks. Many insurers reward these upgrades with discounts. Another approach is to opt for a higher deductible, which can lower your monthly or annual premiums. Bundling insurance policies, such as combining homeowners and auto insurance, is another proven method to achieve cost savings. Some insurance providers also offer discounts for installing eco-friendly features or upgrading roofing materials that are more resilient to local weather challenges. Regularly reviewing your policy for outdated coverage or overlapping benefits can reveal opportunities for savings. By actively seeking discounts and making home improvements, you can achieve a better balance between comprehensive protection and affordable premiums.

10. The Future of Homeowners Insurance: Trends and Innovations

The homeowners insurance landscape is rapidly evolving thanks to technological advancements and changing consumer needs. Innovations such as smart home devices and Internet of Things (IoT) integrations are transforming risk management and claims processing. Insurers are increasingly using data analytics and artificial intelligence to more accurately assess risk and personalize premiums, promising more tailored policies. Additionally, emerging trends in environmental sustainability are influencing policy development, with companies beginning to offer incentives for eco-friendly home improvements that reduce risks related to climate change. Digital platforms have streamlined the claims process, allowing for faster and more efficient communication between policyholders and providers. As the industry evolves, staying informed about these trends will help homeowners anticipate changes in coverage options and make proactive decisions regarding their insurance needs. Embracing technology and innovation in homeowners insurance not only reflects a commitment to modern risk management but also ensures that policyholders enjoy a more responsive and cost-effective service.

Every homeowner should understand the basics of homeowners insurance to safeguard their most significant investment. By learning what coverage entails, how deductibles and premiums interact, and ways to assess risks, you create a strong foundation that protects you when life takes an unexpected turn. Regularly comparing policies and exploring discount opportunities ensures you remain both well-insured and financially agile. As the industry moves towards more innovative and data-driven solutions, homeowners who stay informed will benefit from enhanced service and more personalized options. This knowledge empowers you to navigate the complexities of insurance so that, no matter what challenges arise, you can be confident in your home’s future.