- Overview of Location-Based Rate Factors

- Urban vs. Rural Coverage: What’s the Difference?

- The Role of Crime Rates in Insurance Premiums

- Population Density and Its Impact on Accident Risk

- How Weather Patterns Influence Insurance Costs

- The Effect of Local Traffic Congestion on Claims

- Regional Economic Factors and Their Influence on Rates

- Local Regulations and Insurance Policy Variations

- Adjusting Your Coverage Based on Your Area

- Future Trends: How Evolving Demographics Could Change Your Rates

1. Overview of Location-Based Rate Factors

Your auto insurance premium is not solely determined by your driving record and car type. Your address plays a critical role in shaping the rate. Insurers assess several local factors to determine the probability of receiving a claim. These factors include crime statistics, traffic congestion, weather patterns, and economic conditions. Understanding how location impacts your premiums can empower you to make smarter decisions about coverage.

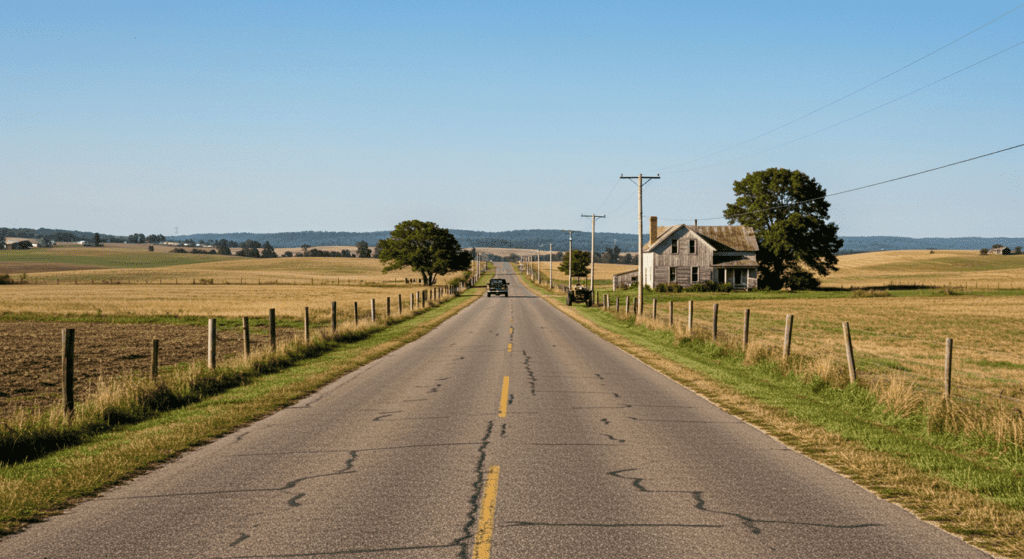

2. Urban vs. Rural Coverage: What’s the Difference?

Living in a busy urban area often results in higher auto insurance rates compared to residing in rural settings. In the city, the chances of accidents, theft, and vandalism are elevated. Moreover, increased traffic complicates driving, leading insurers to adjust their estimates of risk. In rural areas, fewer vehicles and less congestion tend to lower your premium. However, rural residents may face different challenges, such as longer emergency response times, that can also influence coverage costs.

3. The Role of Crime Rates in Insurance Premiums

Insurance companies often factor local crime levels into their pricing models. High incidences of car theft, vandalism, or fraudulent claims in a region can boost your auto insurance premium. In locales with a robust police presence and lower crime rates, insurers are more confident in paying fewer claims and offer more attractive rates. When choosing a home location, consider prospects of safer neighborhoods as a way to manage long-term insurance expenses.

4. Population Density and Its Impact on Accident Risk

High population density affects not only how crowded your living environment is but also drives up the number of cars on the road. Increased vehicle density means higher chances of accidents and collisions. Consequently, urban drivers often pay more for auto insurance since the risk of an accident rises with the number of vehicles. In contrast, suburban or rural areas, with fewer cars per square mile, generally see lower accident rates and, in many cases, more affordable insurance premiums.

5. How Weather Patterns Influence Insurance Costs

Weather is another crucial factor in determining your insurance rates. Areas prone to heavy snow, flooding, or severe storms are likely to experience a higher number of accident claims and property damage incidents. As a result, insurers typically raise premiums in regions with unpredictable or harsh weather conditions. If you live in an area that is susceptible to extreme weather, consider opting for additional coverage. Doing so can help manage risks and potential claim expenses.

6. The Effect of Local Traffic Congestion on Claims

Traffic congestion does not just lead to longer commutes; it also increases the likelihood of accidents. In congested areas, where bumper-to-bumper driving is common, minor collisions are a frequent occurrence. Higher chances of fender benders drive up claim statistics and, indirectly, your insurance rate. Urban drivers, therefore, often experience higher premiums due to the increased risk of claims resulting from daily heavy traffic.

7. Regional Economic Factors and Their Influence on Rates

Economic conditions in your region can subtly influence your insurance costs. In areas where the local economy is robust, there may be more vehicles on the road, increasing competition and driving up accident risks. Conversely, regions with slower economic growth may see fewer vehicles and reduced accident risks, resulting in lower claims. Insurers take these factors into account when calculating premium rates. It is useful to monitor local economic trends to understand how they might impact your personal insurance bill.

8. Local Regulations and Insurance Policy Variations

State and local regulations also have a significant impact on auto insurance policies. Different areas may require specific types of coverage or minimum liability limits. For instance, some states enforce stricter standards, making auto insurance more comprehensive and expensive, while others have less rigorous requirements. Local mandates and legal frameworks lead to variations in policy offerings. Familiarizing yourself with these local regulations can help you find the best coverage options and prevent overpaying for unnecessary features.

9. Adjusting Your Coverage Based on Your Area

Given how location influences insurance rates, it is crucial to tailor your policy to fit your specific needs. If you’re living in an urban environment with higher risk factors, consider investing in higher coverage limits or opting for additional riders that cover theft or vandalism. Conversely, if your life is mostly spent in a rural area, you might find that standard coverage is sufficient, reducing your overall premium. Adjust your policy by reviewing local factors and discussing your specific needs with your insurance provider. Customized coverage can help you manage risk while keeping costs under control.

10. Future Trends: How Evolving Demographics Could Change Your Rates

The way we live and work is changing, and auto insurance is evolving with it. Rapid urbanization, shifts in population density, and changing climate conditions are among the trends that may alter local risk profiles in the coming years. As more people move into urban centers in search of work and lifestyle benefits, increased traffic and congestion could lead to higher accident risks and insurance premiums. On the other hand, improvements in road infrastructure and smarter traffic management systems could counterbalance these risks. It’s important to monitor these demographic trends and be proactive about adjusting your coverage. Staying informed and working with an insurance provider who understands emerging trends can help you maintain affordable rates over time.

Conclusion

Your location is a fundamental aspect of your auto insurance rate determination. From the difference between urban and rural settings to the influence of local weather, crime, and economic conditions, many factors affect your premium. Consumers should closely examine where they live and consider how local conditions might alter their insurance needs. By doing thorough research and consulting with knowledgeable agents, you can secure a policy that fits your unique circumstances. Adaptability is key—whether you’re planning a relocation or simply re-evaluating your current coverage, stay informed and proactive.

In today’s rapidly changing world, being aware of the impact your location has on auto insurance rates is a vital aspect of financial planning. With rising urban density and evolving local regulations, insurers will continue to adjust their models to incorporate these variables. By understanding and adapting to these factors, drivers can take better control of their insurance expenses.

The importance of location in determining your insurance rate cannot be overstated. It remains a powerful determinant in calculating the risks insurers face. When combined with individual factors like driving history and vehicle type, your address signals much more than just where you live—it reveals a snapshot of local risks that directly impact your financial commitments.

Now is the time to evaluate how your living environment influences your auto insurance costs. Whether you reside in a bustling city or a quiet rural neighborhood, understanding local risks and adjusting your coverage accordingly is a wise step towards financial security. Keep an eye on evolving trends—a future where electric vehicles, smart traffic systems, and dynamic local policies further redefine insurance premiums is already on the horizon.

By acknowledging the many ways location factors into your auto insurance, you become better equipped to handle potential increases. From customized policies that address urban risks to cost-saving measures suitable for rural environments, the choices are in your hands. Ultimately, a well-informed decision will ensure that your coverage not only protects you in times of need but also remains cost-effective in the long run.

In summary, your auto insurance rates are intricately linked to where you live. Factors like urban density, local crime statistics, economic conditions, and weather-related risks all weave into the fabric of your overall premium. A careful review of these factors along with a proactive approach in policy management can lead to significant savings and better coverage tailored to your unique lifestyle. Stay informed, consult with experts, and adjust your coverage to match the evolving landscape in order to maintain an optimal balance between protection and expense.