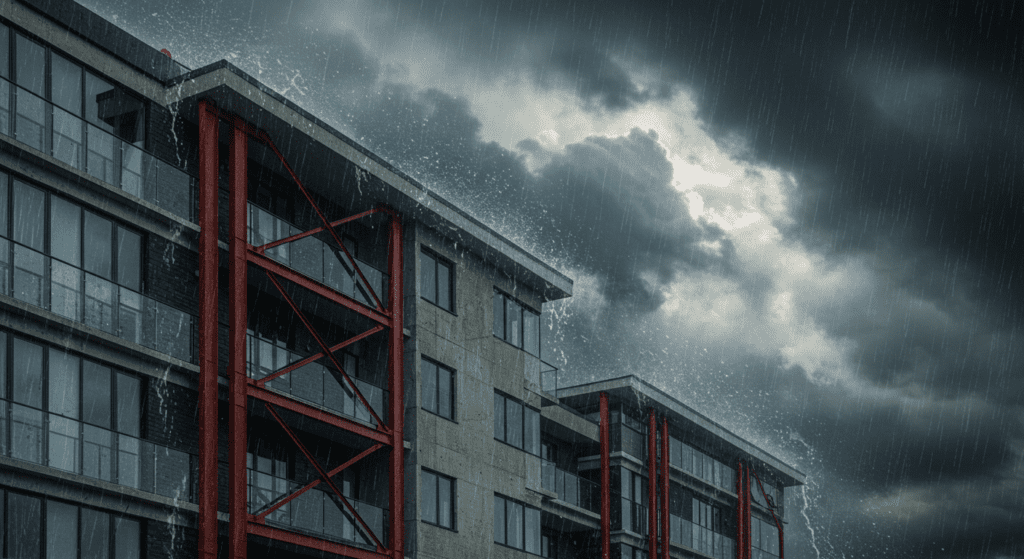

- Introduction: How Weather and Climate Change Affect Apartment Building Insurance Rates

- Current Climate Trends Affecting Urban Structures

- Understanding Apartment Building Insurance: Key Coverage Areas

- The Role of Extreme Weather Events in Risk Assessment

- Climate Change Projections: What Insurers Are Anticipating

- Adjustments in Insurance Policies Due to Environmental Risks

- Mitigation Strategies for Apartment Building Owners

- Highlighting Real-World Case Studies and Loss Data

- Regulatory Changes and Their Impact on Insurance Premiums

- Future Outlook: Adapting to a Changing Climate and Evolving Insurance Practices

1. Key Differences between Apartment Building and Commercial Property Insurance

Weather and climate change are reshaping the landscape of urban living. Apartment buildings, which serve as homes for many people, are not immune from these environmental shifts. Insurers and property owners alike are forced to reassess risk, premiums, and coverage needs. Understanding these changes is essential for both property owners and insurers, as weather phenomena and climate uncertainty drive policy adjustments and influence premiums.

2. Current Climate Trends Affecting Urban Structures

Major cities are undergoing noticeable shifts in weather patterns. Extreme heat waves, increased rainfall, and sudden cold snaps are becoming more frequent. Many urban areas experience higher humidity, rising sea levels, and stronger winds that can weaken building structures. As these trends become the norm, apartment buildings face unique challenges. Aging roofs, outdated windows, and older infrastructure are particularly vulnerable. Decision-makers now rely on updated building codes and retrofitting measures to handle new stressors. Insurers have become more cautious, adding clauses to their policies to compensate for higher risks associated with these climatic variants.

3. Understanding Apartment Building Insurance: Key Coverage Areas

Apartment building insurance offers a safety net for landlords and property owners. Key coverage areas include damage to the structure, liability protection, loss of rental income, and coverage for equipment inside the building. This insurance generally covers natural disasters such as hurricanes, floods, and earthquakes, though coverage can vary widely. As weather patterns evolve, insurers may reexamine policies to ensure that everything from storm damage to wind-related structural impacts is addressed. It is increasingly important for property owners to review their policies and add specific endorsements. This ensures protection against emerging risks from climate change. Doing so helps avoid financial loss due to events that are now more common in urban settings.

4. The Role of Extreme Weather Events in Risk Assessment

Extreme weather events have direct consequences on buildings. Torrential rains can lead to water damage, faulty wiring, and compromised structural integrity. With floods becoming more frequent, the importance of investing in improved drainage systems and waterproofing becomes evident. Insurers now consider these factors while determining policy terms and premiums. The frequency and intensity of storms disrupt the usual risk assessment models. Many insurance companies have updated their underwriting practices to account for rising claims linked to weather-related damages. As a result, policy premiums and deductibles have shifted upward. This makes it vital for apartment building owners to grasp the interconnectedness of extreme weather events and building risks

5. Climate Change Projections: What Insurers Are Anticipating

Looking ahead, climate change projections suggest that urban areas will experience more volatile weather and unpredictable natural phenomena. Insurers are monitoring extensive climate data reported by research institutions and government agencies. Their models indicate that extreme weather events, including prolonged heat waves and abnormal rainfall, will become the new standard in many regions. These projections directly influence insurance premiums. The potential for larger claims forces insurers to recalibrate their risk models. As a consequence, premiums may rise steadily in vulnerable urban areas. Insurers are also studying risk mitigation strategies and are considering offering incentives for building upgrades that reduce environmental risk.

6. Adjustments in Insurance Policies Due to Environmental Risks

Environmental risks have led to adjustments in standard insurance policies for apartment buildings. Policy language now often includes provisions for climate-induced events and references to specific geographic vulnerabilities. Some insurers now require updated building inspections to assign a risk rating that accurately reflects the current environmental conditions. This is particularly true in high-risk zones where flooding, hurricanes, or landslides are now common. In certain cases, insurers require mandatory maintenance checks or retrofitting projects before issuing coverage. Policyholders may benefit from lower premiums if they proactively adopt measures to improve their building’s resilience. This proactive approach not only improves safety but also results in long-term cost savings for insured property owners.

7. Mitigation Strategies for Apartment Building Owners

Owners of apartment buildings have a critical role in managing environmental risks. Mitigation strategies include investing in structural reinforcements, installing new drainage systems, and updating roofing materials to better withstand extreme weather. Regular inspections and maintenance routines are essential. Property owners can also explore smart technology options for monitoring building safety. Installing sensors can provide real-time feedback about environmental conditions inside and around the building. Additionally, investing in energy-efficient systems can both reduce energy costs and qualify for insurance discounts. Many insurers and local governments offer grants and tax incentives for such improvements, further encouraging property owners toward proactive risk management. These measures help create a win-win scenario, reducing risk while maintaining affordable insurance premiums.

8. Highlighting Real-World Case Studies and Loss Data

Real-world case studies provide insights into the direct impact of climate change on apartment building insurance. In cities prone to flooding, several apartment complexes experienced extensive damage during a record rainfall event. Loss data from these incidents indicate that timely mitigation measures could have reduced repair costs by a significant margin. Another case from a coastal city highlighted the impact of hurricanes; structures that had invested in reinforced windows and strengthened roofing faced considerably less damage compared to those that did not. Examining such data helps insurers to refine their risk assessments and develop more accurate models for premium calculation. These case studies also serve as practical reminders for property owners who may be resistant to investing in preventive measures until it is too late.

9. Regulatory Changes and Their Impact on Insurance Premiums

Government regulations play a significant role in shaping insurance practices. Many states and municipalities have introduced new building codes that focus on climate resilience. These regulations aim to ensure that every apartment building is better prepared for future weather events. As governments enforce new standards, property owners may need to upgrade older buildings to stay compliant. While these changes are beneficial in the long run, they can also lead to higher short-term costs. Insurers adjust their premium calculations to reflect these regulatory changes. In some cases, stricter regulations have resulted in temporary premium increases. However, building upgrades not only ensure regulatory compliance but also contribute to long-term savings by reducing claims and damage during extreme events.

10. Future Outlook: Adapting to a Changing Climate and Evolving Insurance Practices

The future of apartment building insurance is set against the backdrop of a rapidly changing climate. Insurers, building owners, and government regulators are increasingly collaborating to shape resilient urban environments. As weather events become less predictable, insurance companies are betting on more sophisticated risk assessment models that leverage big data analytics and climate forecasting. Innovations in sensor technology, better building materials, and community-based risk-sharing models will further transform the landscape of property insurance.

In addition, insurers are likely to offer innovative products that reward proactive mitigation efforts. Discounts for energy-efficient and resilient structures are becoming more common. Technological advancements and data analytics will empower insurers to tailor policies based on a property’s performance and risk level. This customization has the potential to create more affordable and equitable coverage options for apartment building owners. The focus will be on partnerships, where building owners and insurers work together to minimize overall risk.

As cities grow, urban planners are also recognizing the need for climate-conscious designs. Incorporating green roofs, improving ventilation systems, and planning for storm surges are measures that can boost a building’s resilience. These steps not only safeguard lives and properties but also contribute to overall environmental sustainability. The insurance industry plays a supportive role by integrating these initiatives into their policy structures and premium models.

11. Conclusion

Weather and climate change represent significant challenges to the stability of apartment building insurance. With climate trends driving higher risks in urban environments, both insurers and property owners must become more status-aware and proactive in responding to these changes. By understanding key coverage areas, assessing extreme weather risks, and implementing mitigation strategies, apartment building owners can better navigate the complex landscape of insurance policies shaped by environmental factors.

Installing improved building defenses, undergoing regular maintenance checks, and complying with updated building codes are crucial steps to minimize risk. By observing real-world case studies and understanding loss data, both insurers and property owners can gain valuable insights into the link between weather patterns and insurance rates. Regulatory changes further add layers of complexity, as they demand adherence to higher safety standards while influencing premium adjustments.

Looking ahead, adaptation to the evolving insurance landscape is imperative. With better risk models, smart technology, and innovative policy adjustments, there is hope for more stable insurance practices in a changing climate. Both insurance providers and property owners can work together in preparation for a future marked by environmental uncertainty. The key lies in cooperation, informed decision-making, and continual investment in resilient infrastructure to protect not just buildings, but communities as well.