- Introduction: A New Era in Auto Insurance

- The Rise of Usage-Based Insurance Models

- The Role of Telematics in Driving Data Collection

- Benefits for Consumers and Insurers

- How Telematics Technology Works

- Data Privacy and Security in Telematics Programs

- Regulatory and Compliance Considerations

- Impact on Premium Calculations and Risk Assessment

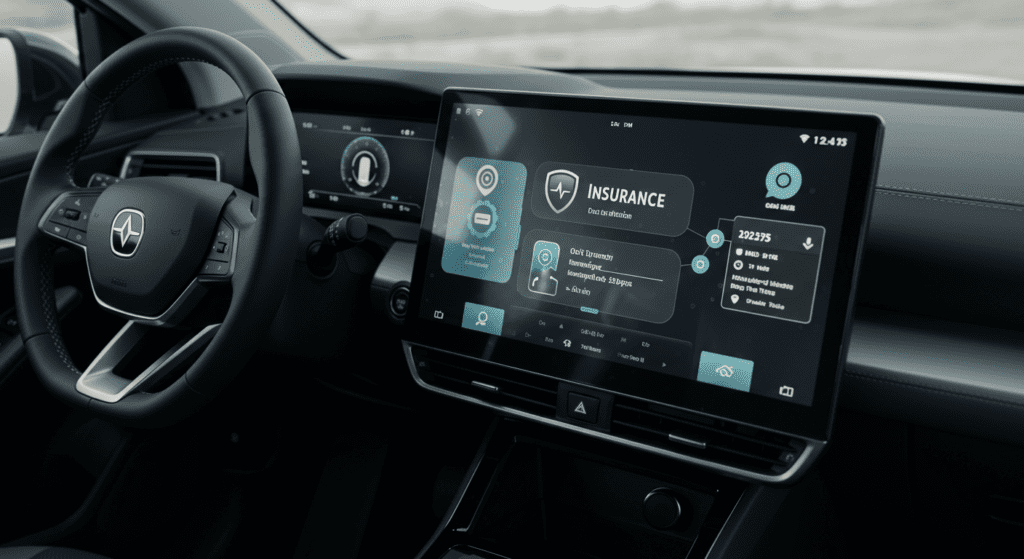

- Integration with Digital Ecosystems and Future Trends

- The Road Ahead: Innovations and Market Evolution

1. Introduction: A New Era in Auto Insurance

Auto insurance is witnessing a revolutionary shift. As the industry becomes increasingly technology-driven, usage-based insurance models and telematics programs are transforming risk assessment and premium calculation. Policyholders now have the opportunity to personalize their coverage based on driving habits, while insurers benefit from more precise data. This new era in auto insurance not only improves safety and efficiency but also creates a transparent environment where consumers and insurers can align interests for better outcomes on the road.

2. The Rise of Usage-Based Insurance Models

Usage-based insurance (UBI) is changing the traditional approach to auto coverage by linking premiums to actual driving behavior rather than statistical averages. Instead of being penalized for generalized risk factors, drivers are assessed based on how, when, and where they drive. This shift benefits careful drivers and encourages safer road habits. As UBI programs gain popularity, more insurers are adopting these models. Their tailored approach helps reduce accidents and rewards good driving, ultimately offering financial savings where it matters most.

3. The Role of Telematics in Driving Data Collection

Telematics technology has become a cornerstone in the evolution of auto insurance. These devices capture comprehensive data on driving patterns, including speed, routes, acceleration, and braking. By leveraging telematics, insurers can monitor real-time behavior and gain insights into risk factors. The collected data not only informs risk assessments but also allows for the adjustment of premiums over time. With a steady stream of information, both consumers and insurers benefit from a dynamic and responsive insurance experience.

4. Benefits for Consumers and Insurers

The advantages of usage-based and telematics programs extend far beyond simple premium adjustments. For consumers, the promise of lower rates, rewards for safe driving, and a personalized experience is appealing. As the system rewards conscientious drivers, it becomes a powerful motivator for improved driving habits. On the other hand, insurers gain detailed insights that enhance risk management. With the ability to offer competitive pricing and respond to real-time data, insurers can reduce fraudulent claims and streamline claim processing. This mutually beneficial environment fosters trust and encourages a more responsible approach to road safety.

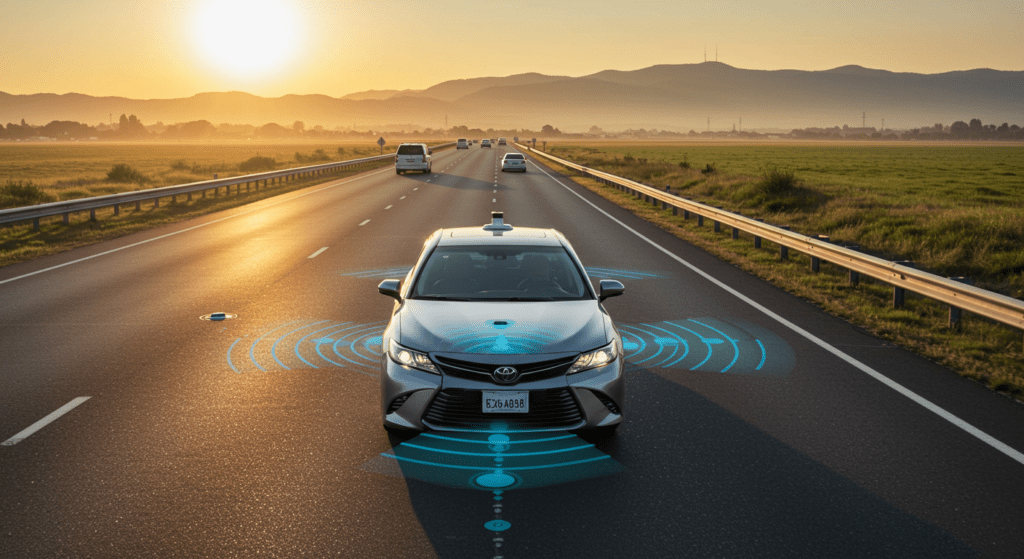

5. How Telematics Technology Works

Telematics devices are often installed in vehicles via a plug-in gadget or embedded within the car’s system. These devices collect data through sensors that record various aspects of driving behavior. Information such as mileage, speed, braking patterns, and even the time of day when a vehicle is in use is calculated. Data is then transmitted to a central database, where insurers analyze the driving trends. This systematic process allows insurance providers to calibrate risk profiles more accurately. The instant feedback provided by telematics systems also helps drivers adjust their habits, leading to a safer driving culture.

6. Data Privacy and Security in Telematics Programs

While the benefits of telematics are evident, concerns regarding data privacy and security remain at the forefront. With large volumes of sensitive information being transmitted, ensuring robust security measures is essential. Insurers and telematics providers adopt stringent measures, such as end-to-end encryption and regular security audits, to protect consumer data. Transparency in how data is collected, stored, and used is crucial for building consumer trust. Regulations and best practices are continually evolving to safeguard privacy without compromising the technological advantages that drive innovation in this sector.

7. Regulatory and Compliance Considerations

The rapid adoption of usage-based insurance and telematics programs has led to heightened regulatory scrutiny. Governments and industry bodies are working together to create frameworks that balance innovation with consumer protection. Regulations have been introduced to guide the collection and use of driving data. These rules often address consent protocols, data retention policies, and security measures. By adhering to these regulatory standards, insurers can foster a fair and secure marketplace. Consequently, both consumers and insurers can benefit from the many advantages without risking undue privacy intrusions.

8. Impact on Premium Calculations and Risk Assessment

The integration of telematics into insurance practices has led to a paradigm shift in premium calculations. Instead of relying solely on historical data and averages, insurers now use real-time information to assess risk on a more granular level. Drivers who exhibit safe habits see a reduction in their premiums, while those with riskier behaviors might face higher costs. This precise allocation of risk helps level the field, making auto insurance fairer and more representative of an individual’s driving profile. Moreover, the predictive capabilities of telematics enable insurers to anticipate potential issues before they escalate, further refining risk management strategies.

9. Integration with Digital Ecosystems and Future Trends

The evolution of auto insurance is closely linked to broader digital trends. As smart cities and connected vehicles become more common, the integration of telematics with digital ecosystems will deepen. Future smart car technology may feed more in-depth driving data into insurance algorithms, paving the way for even more refined risk assessments. Moreover, the rise of mobile apps and cloud-based systems offers consumers enhanced access to their data and coverage details. This seamless integration means that users can monitor their driving performance, receive instant feedback, and even adjust coverage in real-time. As innovations continue to evolve, the auto insurance landscape will likely see partnerships between tech giants and traditional insurers, fostering an environment of collaborative progress.

10. The Road Ahead: Innovations and Market Evolution

The future of auto insurance looks promising as usage-based and telematics programs gain traction. Industry experts predict that these innovations will lead to broader adoption across markets worldwide. As the technology matures, insurers will harness artificial intelligence and machine learning to further analyze driving behavior. This combination of data and analytics will undoubtedly enhance predictive modeling and risk assessment. Consumers can look forward to more personalized policies that evolve in response to their behavior and needs.

What does this evolution mean for the market? Simply put, a more competitive and customer-centric industry. Insurers will be able to innovate with loyalty programs, incentives for eco-friendly driving behaviors, and even integration with health and wellness programs. As premium calculations become more precise, the gap between high-risk and low-risk drivers will likely narrow. A more dynamic and transparent insurance framework means drivers will be better informed about their driving habits and the corresponding risks. This clarity can drive improvements in both individual driving behaviors and overall road safety.

Looking further ahead, the impact of innovations such as 5G connectivity and advanced sensor technologies will further enhance the capabilities of telematics programs. With faster data transmission and more reliable connectivity, real-time monitoring will become even more accurate. This robust data ecosystem will allow for immediate policy adjustments based on current driving conditions. The convergence of these technological innovations promises an exciting array of future applications that could redefine the auto insurance domain entirely.

Conclusion

In conclusion, the innovations in auto insurance marked by usage-based and telematics programs are creating a smarter, safer environment on the roads. Consumers benefit from personalized policies and rewards for safe driving, while insurers gain a better understanding of risk factors through precise data collection. As industry players navigate regulatory challenges and embrace digital integration, the road ahead is paved with potential for further advancements. Embracing these new technologies not only enhances overall safety but also sets the stage for a more efficient, transparent, and fair insurance market for all.