- Understanding Telematics: A Foundation for Modern Trucking

- Key Technologies Driving Insurance Premium Changes

- Data Collection Methods in Telematics Systems

- Impact of Driver Behavior Monitoring on Insurance Rates

- Enhanced Risk Management Through Real-Time Data

- Cost Savings for Fleet Operators Using Telematics

- Case Studies: Telematics Success Stories in Trucking

- Challenges in Integrating Technology with Insurance Models

- The Future of Telematics and Its Role in Insurance Premiums

- Balancing Technology Adoption with Cost Considerations

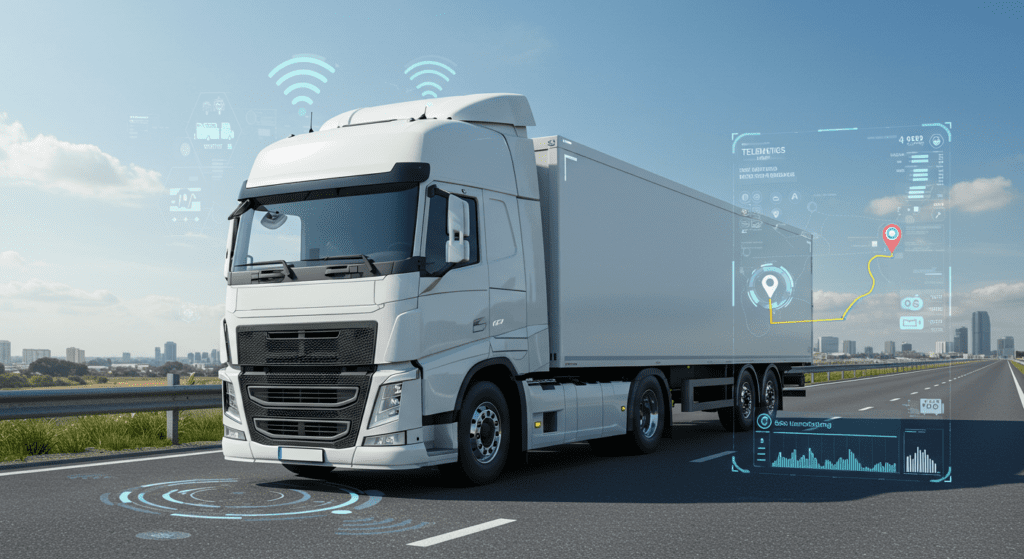

1. Understanding Telematics: A Foundation for Modern Trucking

Telematics has revolutionized the trucking industry by integrating telecommunications and information technology. It provides real-time data on vehicle locations, performance, and driver behavior, enabling fleet managers to make informed decisions. By leveraging GPS tracking, onboard diagnostics, and wireless communication, telematics systems offer comprehensive insights that enhance operational efficiency. This foundational technology not only improves route planning and fuel management but also plays a critical role in safety and compliance. As the backbone of modern trucking, telematics sets the stage for advanced applications, including predictive maintenance and automated reporting, ensuring that fleets remain competitive and responsive to market demands.

2. Key Technologies Driving Insurance Premium Changes

Several advanced technologies are influencing the shifts in insurance premiums within the trucking sector. Telematics devices collect vast amounts of data on driving patterns, vehicle usage, and environmental conditions. Artificial intelligence and machine learning algorithms analyze this data to assess risk more accurately, leading to personalized insurance rates. Additionally, advanced driver-assistance systems (ADAS) enhance safety by reducing the likelihood of accidents, which insurance companies reward with lower premiums. The integration of Internet of Things (IoT) devices allows continuous monitoring of fleet operations, providing insurers with up-to-date information that helps in adjusting premiums dynamically. These technologies collectively contribute to more precise and fair insurance pricing models.

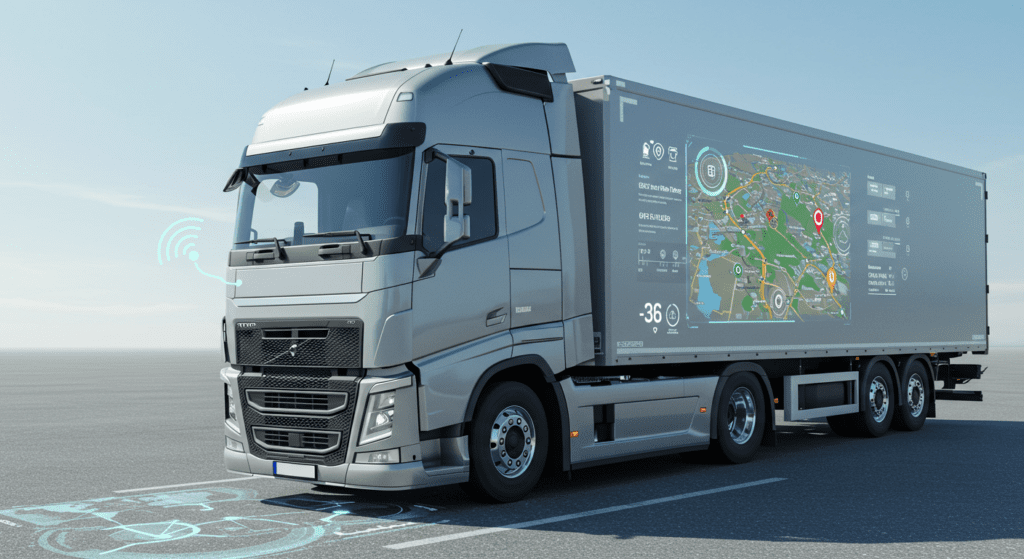

3. Data Collection Methods in Telematics Systems

Telematics systems employ various methods to gather critical data for truck fleet management and insurance assessment. GPS tracking devices record the precise location and movement of each vehicle, enabling detailed route analysis. Onboard sensors monitor engine performance, fuel consumption, and vehicle health, providing insights into maintenance needs and operational efficiency. Driver behavior is tracked through accelerometers and gyroscopes, which detect harsh braking, rapid acceleration, and sharp turns. Additionally, telematics systems can incorporate video monitoring and in-cab cameras to capture real-time footage of driving conditions and driver interactions. This comprehensive data collection ensures that fleet managers and insurers have access to accurate and actionable information.

4. Impact of Driver Behavior Monitoring on Insurance Rates

Monitoring driver behavior through telematics has a significant impact on insurance rates for trucking fleets. Insurers use data on driving habits such as speed, braking patterns, and adherence to traffic rules to evaluate risk levels. Drivers who exhibit safe driving practices are rewarded with lower premiums, while those with risky behaviors may face higher costs. This direct correlation incentivizes drivers to adopt safer habits, reducing the likelihood of accidents and claims. Additionally, real-time feedback from telematics systems allows for immediate corrections and training opportunities, further enhancing driver safety. By linking insurance rates to measurable behaviors, telematics promotes a culture of responsibility and accountability within the fleet.

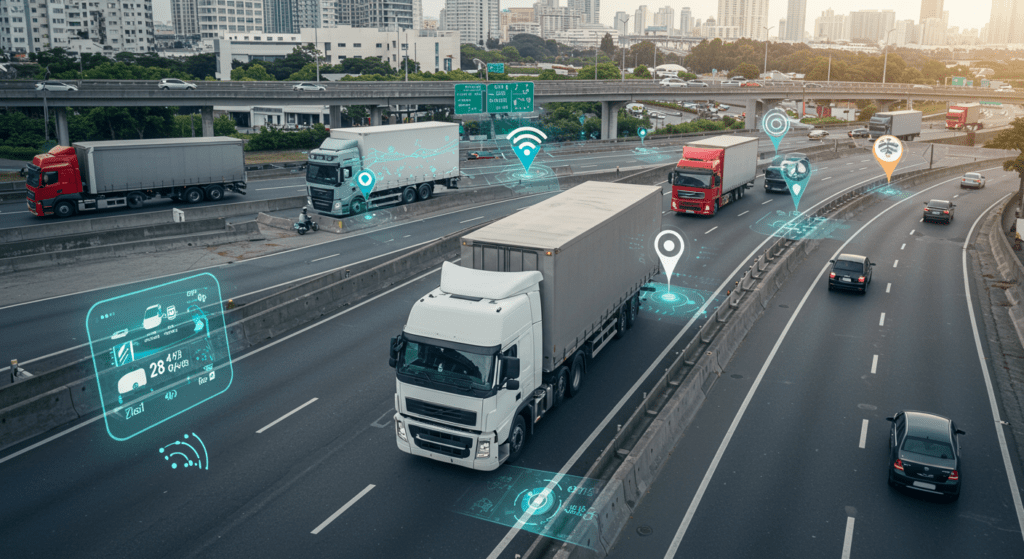

5. Enhanced Risk Management Through Real-Time Data

Real-time data provided by telematics systems enhances risk management for trucking companies and insurers alike. Immediate access to vehicle locations and status allows for proactive responses to potential issues, such as mechanical failures or route deviations. Real-time monitoring of driving behavior helps identify and mitigate risky practices before they result in accidents. Additionally, instant alerts for unauthorized vehicle use or extreme driving conditions enable swift corrective actions, minimizing potential losses. For insurers, real-time data facilitates more accurate underwriting and claims processing, leading to improved risk assessment and management. This dynamic approach to risk management contributes to safer operations and more efficient insurance practices.

6. Cost Savings for Fleet Operators Using Telematics

Implementing telematics systems offers substantial cost savings for fleet operators in the trucking industry. By optimizing routes and improving fuel efficiency, telematics reduces operational expenses significantly. Enhanced vehicle maintenance through predictive analytics minimizes downtime and extends the lifespan of fleet assets, lowering repair costs. Monitoring driver behavior also decreases the likelihood of accidents, reducing expenses related to insurance claims and vehicle damage. Additionally, telematics enables better asset utilization, ensuring that vehicles are used effectively and reducing unnecessary expenditures. These cumulative savings not only improve the bottom line but also provide a competitive advantage in the marketplace.

7. Case Studies: Telematics Success Stories in Trucking

Numerous trucking companies have achieved remarkable success by integrating telematics into their operations. For instance, a major logistics firm implemented a telematics solution that resulted in a 15% reduction in fuel costs through optimized routing and improved driver efficiency. Another company utilized telematics data to enhance safety protocols, leading to a 20% decrease in accident rates and lower insurance premiums. A regional carrier leveraged real-time data to streamline maintenance schedules, reducing vehicle downtime by 25% and extending fleet lifespan. These case studies demonstrate the tangible benefits of telematics, showcasing how data-driven strategies can transform fleet management and insurance outcomes.

8. Challenges in Integrating Technology with Insurance Models

Integrating telematics technology with existing insurance models presents several challenges. Data privacy and security concerns must be addressed to protect sensitive information collected by telematics systems. Insurers need to develop standardized data protocols to ensure consistency and reliability in risk assessment. Additionally, there may be resistance from stakeholders accustomed to traditional insurance practices, requiring education and adaptation. The initial investment in telematics infrastructure can be a barrier for some fleet operators, although long-term savings often justify the expense. Furthermore, aligning telematics data with actuarial models requires sophisticated analytics capabilities, necessitating significant technological advancements and collaboration between insurers and technology providers.

9. The Future of Telematics and Its Role in Insurance Premiums

The future of telematics in the trucking industry promises even greater integration and innovation, particularly in relation to insurance premiums. Advances in artificial intelligence and machine learning will enable more precise risk assessments and dynamic premium adjustments based on real-time data. The rise of autonomous and semi-autonomous trucks will further transform telematics applications, with insurance models evolving to account for new risk factors and safety features. Enhanced connectivity through 5G and IoT will facilitate seamless data transmission and real-time monitoring, providing insurers with unprecedented levels of insight. As telematics continues to evolve, its role in shaping insurance premiums will become increasingly central, driving more personalized and fair pricing structures.

10. Balancing Technology Adoption with Cost Considerations

Balancing the adoption of telematics technology with cost considerations is crucial for trucking companies aiming to maximize benefits while managing expenses. Fleet operators must evaluate the return on investment (ROI) by assessing potential savings in fuel, maintenance, and insurance against the initial and ongoing costs of telematics systems. Selecting scalable and customizable solutions allows companies to tailor telematics features to their specific needs, ensuring cost-effectiveness. Additionally, exploring financing options and seeking incentives or subsidies can alleviate financial burdens. Training and change management are also essential to ensure that the technology is used effectively, maximizing its impact on operational efficiency and cost savings. By strategically balancing technology adoption with financial considerations, trucking companies can harness the full potential of telematics without overextending their budgets.