- Understanding Credit Scores and Their Determinants

- How Auto Insurance Companies Use Credit Information

- The Connection Between Financial Behavior and Insurance Costs

- The Impact of Low Credit Scores on Premiums

- Strategies to Improve Your Credit Score for Better Rates

- Comparing Traditional Risk Factors with Credit-Based Assessments

- Regulatory Perspectives on the Use of Credit Scores in Insurance

- Case Studies: Real-Life Examples of Credit Score Impacts

- Alternatives and Additional Ways to Qualify for Lower Rates

- Future Trends: Evolving Practices in Credit Scoring and Auto Insurance

1. Understanding Credit Scores and Their Determinants

Credit scores play a crucial role in many aspects of financial life, including auto insurance rates. A credit score is a number that summarizes your credit history, based on factors like payment history, levels of outstanding debt, types of credit used, and recent credit inquiries. Lenders and insurance companies alike look at these factors to assess risk. A higher credit score generally indicates responsible financial behavior, while a lower score might signal potential risk to insurers and creditors.

2. How Auto Insurance Companies Use Credit Information

Insurance companies have found that credit information can be a useful indicator of a policyholder’s risk profile. When you apply for auto insurance, companies may run a credit check to determine your premium rate. A solid credit history suggests that you are less likely to file a claim, while a poor history increases the perceived risk, often resulting in higher insurance rates. This method helps insurers set premiums that are reflective of the potential risk each customer brings to the table.

3. The Connection Between Financial Behavior and Insurance Costs

Your financial behavior directly impacts your auto insurance cost. Insurers believe that individuals who manage their finances well are less likely to be involved in accidents or make fraudulent claims. A steady record of responsible financial decisions can imply that you will also take responsible actions on the road. Studies have shown that drivers with higher credit scores tend to file fewer claims, making them more attractive to insurance companies looking to reduce their risk exposure.

4. The Impact of Low Credit Scores on Premiums

Low credit scores can significantly increase your auto insurance premiums. People with lower scores are viewed as higher risk due to potential financial instability. This often means that insurance companies will charge them more for coverage. The increase in premiums is a way for insurers to cover the extra risk associated with lower credit scores. Consumers with low credit may find it difficult to afford the same level of coverage as those with better financial backgrounds. Over time, the higher costs can have a strong impact on overall expenses.

5. Strategies to Improve Your Credit Score for Better Rates

Improving your credit score can lead to better auto insurance rates. Start by reviewing your credit report for accuracy and disputing any errors you may find. Make timely payments on all outstanding debt, as payment history is a major factor in your score. Reducing your overall debt load and keeping your credit utilization low can also help. Additionally, consider setting up automatic payments or reminders to avoid missing due dates. Over time, these steps contribute to a healthier credit profile, which can result in lower insurance costs as you demonstrate responsible financial habits.

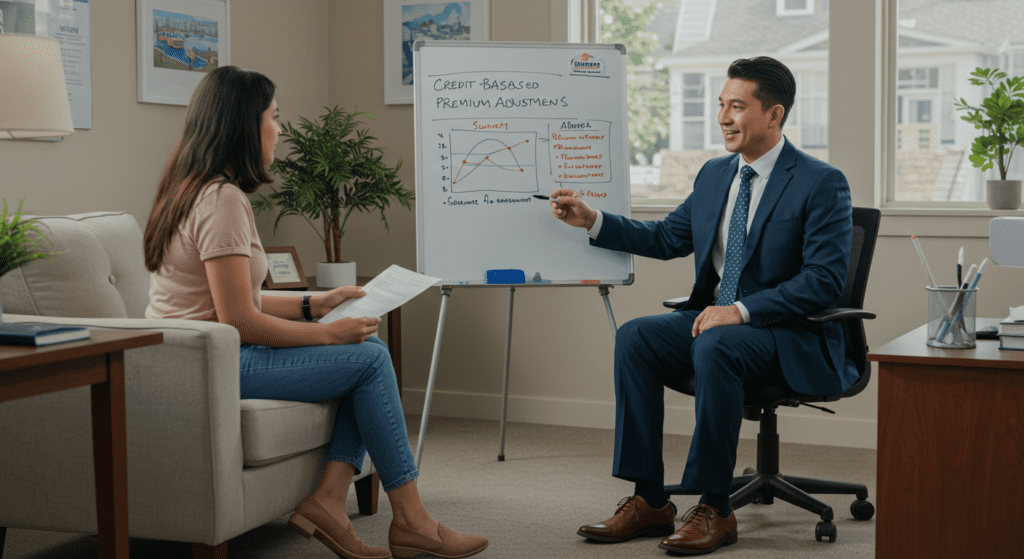

6. Comparing Traditional Risk Factors with Credit-Based Assessments

Traditionally, auto insurance rates were driven mostly by factors such as driving records, age, vehicle type, and mileage. Today, credit scores have joined that list as an additional indicator of risk. While a spotless driving record is important, many insurers now believe that a consumer’s financial behavior provides further insight into risk levels. This has led to a more layered risk assessment model where both driving habits and financial behavior are weighed together. Consumers should understand that while both factors matter, maintaining a good credit score has become increasingly important in managing overall auto insurance costs.

7. Regulatory Perspectives on the Use of Credit Scores in Insurance

The use of credit scores in determining auto insurance rates is not without controversy. Various state and national regulatory bodies have weighed in on whether this practice is fair. Some regulators argue that relying on credit scores could disproportionately harm individuals who have faced financial hardships, while others maintain that it is a statistically valid method of risk assessment. As a result, some states have imposed restrictions or guidelines on how credit information can be used by insurance companies. These regulations aim to ensure that the practice does not unfairly penalize those who may have experienced temporary financial setbacks.

8. Case Studies: Real-Life Examples of Credit Score Impacts

Consider the example of two drivers with similar vehicles and driving histories but different credit scores. Driver A, with a strong credit score, might be offered a premium that is significantly lower than that offered to Driver B who has a weaker score. In another case, an individual who improved their credit score dramatically over the course of a few years found that their auto insurance premiums were reduced accordingly. These examples illustrate how credit scores can directly influence what drivers pay for insurance and underscore the importance of maintaining a healthy credit profile.

9. Alternatives and Additional Ways to Qualify for Lower Rates

Even if you have a less-than-stellar credit score, there are other methods to qualify for lower auto insurance rates. Many companies offer discounts for safe driving records, bundling policies, and even for vehicles equipped with advanced safety features. Installing anti-theft systems in your vehicle or taking defensive driving courses may also lower your premiums. By taking a proactive approach, you can qualify for additional discounts that help offset the costs related to a lower credit score. Researching and comparing multiple insurers can reveal providers who focus more on other risk factors rather than credit alone.

10. Future Trends: Evolving Practices in Credit Scoring and Auto Insurance

The use of credit scores in shaping auto insurance premiums is likely to evolve as technology and data analytics improve. Insurers continue to explore a broader range of data points, including telematics data from vehicles, driving behavior analytics, and even social media insights. This evolution may lead to more personalized insurance policies that rely less on general credit scores and more on actual driving behavior. Consumers may benefit from these changes as insurers shift toward models that can more accurately predict risk on an individual basis. These trends suggest that while credit scores currently play a significant role in determining auto insurance rates, future innovations may lead to a more holistic approach.

Conclusion

In summary, credit scores are an important component in determining auto insurance premiums. The factors behind credit scores show insurers a clear picture of your reliability and financial behavior. By understanding how auto insurance companies use this information, you can take targeted actions to improve your credit and ultimately lower your premiums. Even if your credit isn’t as strong as you’d like, there are alternative ways to reduce your insurance costs. As regulators continue to monitor the use of credit information and as technology advances, the landscape of auto insurance pricing is set to evolve. Taking proactive steps now not only improves your financial health but could save you money on auto insurance for years to come.

By staying informed about how credit scores affect your auto insurance rates, you can better manage your finances and ensure that you are getting the best possible deal on your policy. Consumers are encouraged to educate themselves on both traditional and credit-based risk factors. While both play significant roles, focusing on improving your credit score remains a key strategy. With increased regulatory oversight and emerging trends in data utilization, the relationship between credit scores and insurance premiums will continue to be dynamic. However, with the right information and strategies, you can navigate the system effectively, qualify for lower rates, and make informed decisions that benefit your long-term financial wellbeing.