- Assessing Your Current Insurance Policy

- Implementing Safety Training Programs

- Maintaining a Clean Driving Record

- Selecting the Right Coverage Levels

- Increasing Your Deductible

- Leveraging Telematics and Fleet Tracking

- Consolidating Insurance Policies

- Regularly Reviewing and Updating Your Policy

- Seeking Discounts for Experienced Drivers

- Partnering with Insurance Brokers Specializing in Trucking

1. Assessing Your Current Insurance Policy

Start by thoroughly reviewing your existing insurance policy to understand coverage limits, exclusions, and premiums. Identify areas where your policy may be lacking or where you’re overpaying. Compare your current coverage with industry standards to ensure it meets your specific trucking needs. Pay attention to liability limits, cargo coverage, and any additional riders that could benefit your operations. Assessing your policy helps you make informed decisions about necessary adjustments or potential savings.

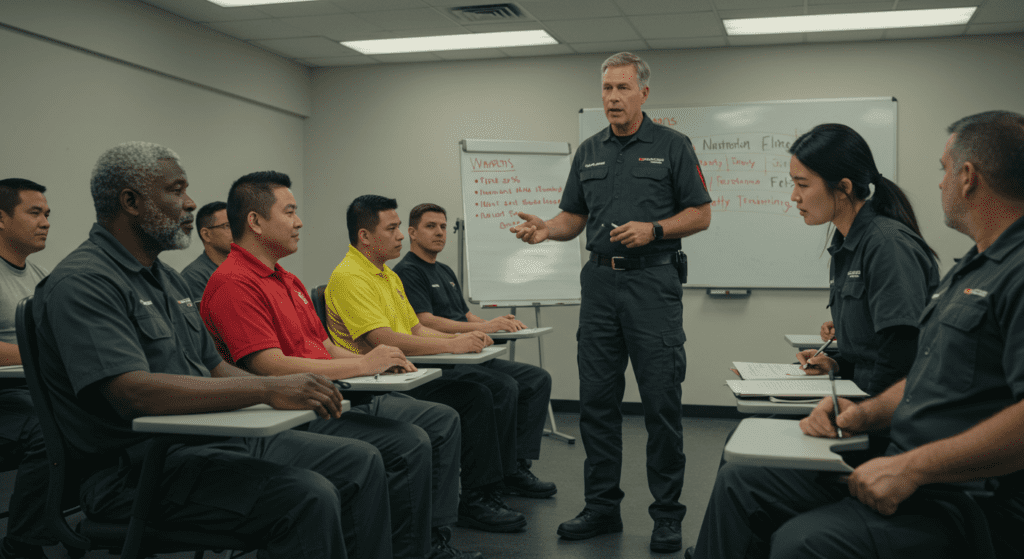

2. Implementing Safety Training Programs

Investing in comprehensive safety training programs for your drivers can significantly reduce the risk of accidents and claims. Regular training sessions on defensive driving, proper load handling, and awareness of road hazards enhance driver competence and confidence. Well-trained drivers are less likely to be involved in accidents, which can lead to lower insurance premiums. Additionally, demonstrating a commitment to safety can make your company more attractive to insurers, potentially resulting in better rates.

3. Maintaining a Clean Driving Record

A clean driving record is one of the most effective ways to lower your insurance costs. Encourage your drivers to adhere to traffic laws, avoid speeding, and refrain from reckless driving. Implement monitoring systems to track driving behavior and provide feedback to drivers. Fewer accidents and traffic violations translate to lower claims for insurers, which can lead to reduced premiums for your fleet. Recognize and reward safe driving habits to promote a culture of responsibility and care on the road.

4. Selecting the Right Coverage Levels

Choosing appropriate coverage levels is crucial for balancing protection and cost. Assess the specific risks associated with your operations, such as cargo type, routes, and vehicle types, to determine adequate coverage. Avoid over-insuring, which can inflate premiums unnecessarily, while ensuring you have sufficient protection against potential liabilities. Tailoring your coverage to your unique needs helps optimize your insurance spend without compromising on essential protection.

5. Increasing Your Deductible

Opting for a higher deductible can lower your insurance premiums. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. By increasing this amount, you take on more financial responsibility in the event of a claim, which reduces the insurer’s risk and can lead to lower premiums. Ensure that the deductible you choose is manageable for your business’s financial situation, balancing immediate savings with potential future costs.

6. Leveraging Telematics and Fleet Tracking

Utilizing telematics and fleet tracking technologies provides valuable data on vehicle performance and driver behavior. These systems monitor speed, braking patterns, and route efficiency, allowing you to identify areas for improvement. Insurers often offer discounts to companies that use telematics, as it reduces risk by promoting safer driving habits. Additionally, real-time tracking can enhance security and reduce theft, further contributing to lower insurance costs.

7. Consolidating Insurance Policies

Combining multiple insurance policies with a single provider can lead to significant savings. Many insurers offer discounts for bundling coverage, such as liability, cargo, and physical damage insurance, into one package. Consolidation simplifies administration and can provide better terms and rates through increased business loyalty. Review your current policies to identify opportunities for consolidation and negotiate with insurers to maximize your discounts.

8. Regularly Reviewing and Updating Your Policy

Regularly reviewing and updating your insurance policy ensures it remains aligned with your business’s evolving needs. As your fleet grows or your operations change, your insurance requirements may shift. Conduct annual reviews with your insurance broker to assess coverage adequacy, identify new risks, and explore potential savings. Staying proactive in policy management helps prevent gaps in coverage and ensures you’re always getting the best possible rates.

9. Seeking Discounts for Experienced Drivers

Insurance providers often offer discounts for fleets with experienced and long-tenured drivers. Demonstrating a stable and experienced driver base reduces the perceived risk, as seasoned drivers are typically less likely to be involved in accidents. Highlight your drivers’ experience and training in your insurance applications and negotiate for discounts based on their proven track records. This approach not only lowers premiums but also reinforces the value of investing in skilled personnel.

10. Partnering with Insurance Brokers Specializing in Trucking

Collaborate with insurance brokers who specialize in the trucking industry to navigate the complexities of coverage and find the best rates. Specialized brokers understand the unique risks and regulatory requirements of trucking operations, allowing them to tailor policies to your specific needs. They can leverage their industry connections to access exclusive discounts and provide expert advice on risk management. Partnering with a knowledgeable broker ensures you receive comprehensive coverage at competitive prices.